Begin typing your search...

Falling GDP and rising inequality a bane

The country has been pushed into a vicious cycle of lower demand and supply and poor economic activity.

Chennai

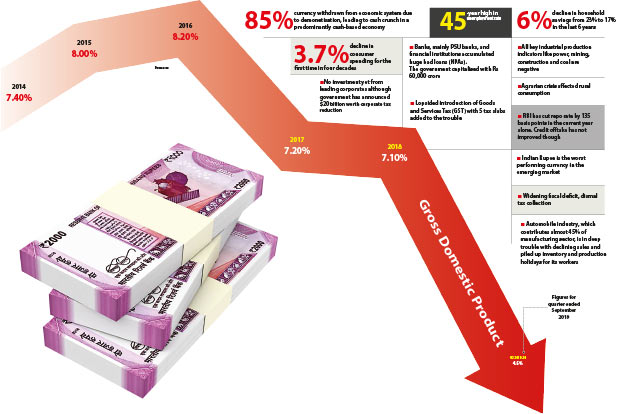

As the growth in Gross Domestic Product (GDP) continues to decline, touching 4.5 per cent in the last quarter ending September 30, 2019, the lowest in seven years, economists are concerned at the growing inequality in society.

The economy is caught in a vicious cycle of lower purchasing power, lower demand and consequently lower production.

Economist and member of the Kerala State Planning Board, Prof K N Harilal, says, “When inequality increases, it takes away purchasing power from the people. Both wealth and income are concentrated on the richer segment of society.

They don’t consume much. Consumption should come from the middle and lower class people. Now it is reflecting on demand.”

Rating agencies and economists believe that GDP growth for the current year will not cross the 5 per cent mark-a sharp decline from 8.2 per cent in 2016.

A top economist at a leading research institute, who did not want to be identified, said, “The system needs credibility to perform. If you don’t have credibility, the system will collapse. People won’t invest in such a system.

The government has to reinstate credibility into the system to address the economic decline.” He said India’s economic growth rate is driven by inequality. The widening gap is an ideal condition for low demand.

Oxfam India’s annual inequality report (2019) says the bottom 60 per cent of the Indian population owns merely 4.8 per cent of India’s national wealth. In the last 12 months, however, the top one per cent sharply increased their wealth by 39 per cent whereas the wealth of the bottom 50 per cent went up by a mere three per cent, well below the inflation rate.

On India’s widening inequality, Oxfam International Executive Director, Winnie Byanyima, said at the WEF summit, “If this obscene inequality between the top one per cent and the rest of India continues, then it will lead to a complete collapse of the social and democratic structure of the country.”

Prof Harilal further said, “Economic recession should not be treated in isolation. On the domestic front, there are a slew of factors that have contributed to the decline: agricultural growth is sliding, key production drivers of the economy are in negative territory and exports have been affected. Globally, trade has not expanded.

The developed world, especially the US, is becoming more protective, placing restrictions on global trade, leading to increased sanctions and trade war.”

Demonetisation withdrew 85 per cent of cash in circulation from a predominantly cash-based economy. “That was a huge shock to the economy; SMEs and the unorganised sector have been badly affected.

The result was massive retrenchment and ballooning unemployment,” said economist Prof L Anitha Kumary of the Gulati Institute of Finance and Taxation.

After demonetisation, the Modi government dealt another blow through the Goods and Services Tax (GST) without taking the business community into confidence and without a proper implementation system in place.

Both these misadventures took away the animal spirit from the economic system. People lost jobs, companies reduced workforce, halted expansion, and unemployment has peaked to a 45-year high.

Madan Sabnavis, chief economist at CARE Ratings, said, “Sharp decline is coming from low demand, and low demand is from low consumption and lower investment. Consumption is not increasing because household income is not going up.”

The “fear factor” and “policy uncertainty” have hurt the industry, said an automobile industry expert, citing the example of the government’s move for hurried attempt at replacement of conventional vehicles with electric vehicles, which affected the auto industry.

Reacting to the sliding GDP growth, former Prime Minister Manmohan Singh, who led the UPA government with an eight per cent growth rate for a decade, said the current state of the Indian economy is “worrisome” and “unacceptable”.

“Mere changes in economic policies will not help revive the economy,” he added. He also said the climate of fear should be changed and confidence brought into the economy to start growing at eight per cent.

After much delay, the government is trying to reverse the decline. It has slashed corporate taxes, infused capital in PSU banks and merged banks, announced privatisation of PSUs like Air India and BPCL and set up a real estate fund to revive the real estate sector.

But while most of these initiatives aim to improve the supply side, the demand side has seen no major initiatives.

On the job front, reports are not encouraging. No new expansion is happening and no new investment is made by companies, whereas India adds about one million working age population every month to the job market.

The industry’s capacity utilisation is low and companies are not ready to invest more. Investment in infrastructure from the private sector is drastically down as banks are not willing to lend for the long term, said Sabnavis.

Experts feel that an emerging economy like India cannot afford a slow growth rate. They think it should continuously grow at a minimum of eight per cent to solve some of the basic issues like poverty and unemployment. Declining growth of below five per cent is a “serious” issue.

Prof Harilal suggested thus: “The government should unleash a major infrastructure programme. It should not bother about fiscal deficit. It can afford a higher fiscal deficit in extraordinary situations. That will revive the demand. We have done it earlier.

Everybody is afraid of international rating agencies. If you want an autonomous economic policy, you have to cut down the dependency on international finance.”

Economists are unanimous in their views that the agriculture sector, where 40 per cent of the population is employed, needs revival. It requires huge funds that will improve productivity.

That is the only solution for improving rural economy and demand. Similarly, investment in health and education is required for sustainable growth. But revival will be a slow progress.

News Research Department

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android

Next Story