Begin typing your search...

Next GST Council meet to decide on anti-profiteering mechanism

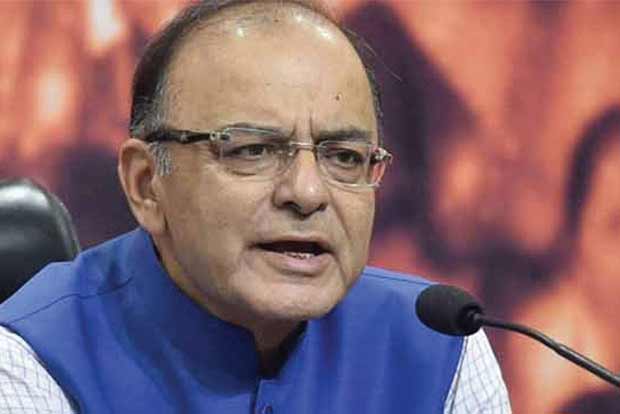

The GST Council, at its next meeting later this week, will finalise a mechanism to operationalise anti-profiteering clause which seeks to protect consumers interest, Finance Minister Arun Jaitley told the Lok Sabha.

New Delhi

The all powerful GST Council comprising state finance minister will meet on August 5 to take stock of implementation of GST which was rolled from July 1.

The anti-profiteering law simply states that the businesses have to pass on the benefits arising out of lower taxes to the consumer.

As per Clause 171 of GST Act, it is mandatory to pass on the benefit due to reduction in rate of tax or from input tax credit to the consumer by way of commensurate reduction in prices.

Referring to concerns raised by members with regard to impact of GST on prices, Jaitley said it would be mandatory for manufacturers to pass on the benefits of reduction in taxes to consumers.

He hoped that the decision of price cut by automobile sector on account of benefit of input tax credit would be followed by others manufacturers.

"What if input tax benefit is not transfered to consumers?...we are meeting a few days from now...In a short while, we are going to finalise the entire mechanism as far as anti-profiteering is concerned.

"All you need is to make a few examples and then everybody will fall in line. If there is benefit of the input credit then cost correspondingly must decline," he said while replying to a discussion on Supplementary Demands for Grants which was later passed by the Lok Sabha.

The industry was resistant to this clause, he said, adding, it has been put in the GST law for initial few years to save the interest of consumers.

After taking into account input tax credit, weighted average tax is less than what it was on June 30, Jaitley said.

It will also help in increasing the tax base and enhancing resources for the government for states as well as central government.

As many as 72 lakh businesses have migrated to GSTN while 13 lakh new users have also registered against 80 lakh dealers prior to GST, the finance minister said.

Citing other benefits, he said, removal of octroi has resulted in saving of both fuel and time for truckers.

GST impact is not only on indirect taxes but on direct taxes as well, he said.

With the Goods and Services Tax Network (GSTN) being put place, tax evasion cannot take place, he said.

On some of the concerns of Telangana, he said, the GST Council will consider those.

"That's an issue that Telangana government has raised.

The Council will consider it. It is an important issue," he said.

Among various issues, the Telangana government had raised issue of taxation on beedis and granite.

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android

Next Story