Vedanta Resources’ chip plans won’t erode liquidity: S&P

Vedanta and its partner and Taiwanese electronics manufacturing giant Foxconn last week signed a pact with the Gujarat government for setting up a semi-conductor factory in Gujarat.

NEW DELHI: Mining mogul Anil Agarwal-led Vedanta Resources’ credit profile will unlikely be weighed down by the group’s planned Rs 1.54 lakh crore foray into semi-conductor manufacturing, S&P Global Ratings said on Monday.

“This is because the company has reiterated that the $20 billion related investment will be carried out outside of Vedanta Resources. The business will be undertaken in a separate entity under Vedanta Resources’ holding company Volcan Investments Ltd,” it said.

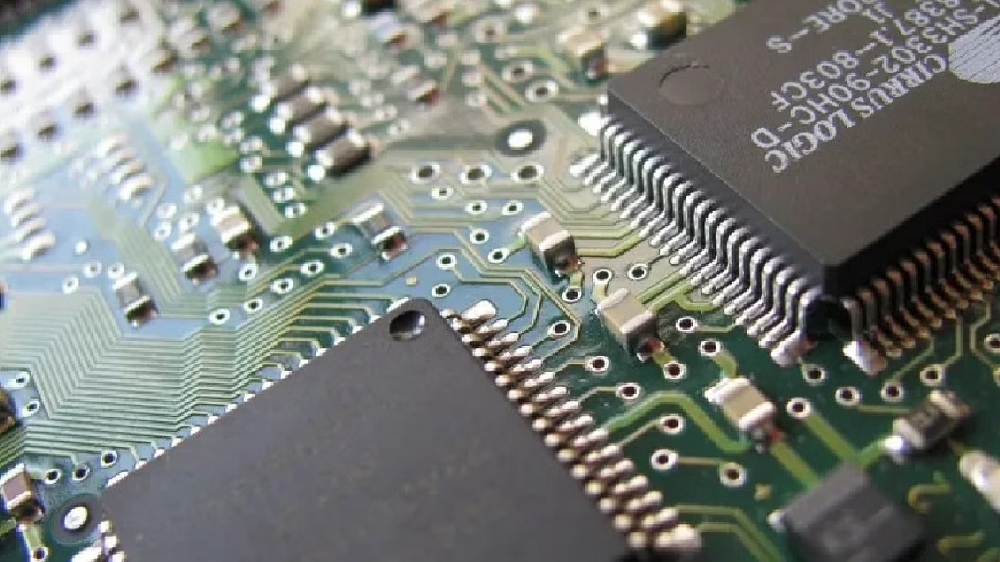

Vedanta and its partner and Taiwanese electronics manufacturing giant Foxconn last week signed a pact with the Gujarat government for setting up a semi-conductor factory in Gujarat. Semi-conductor chips, or microchips, are essential pieces of many digital consumer products - from cars to mobile phones and ATM cards.

The Indian semi-conductor market was valued at $27.2 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of nearly 19 per cent to reach $64 billion in 2026. But none of these chips is manufactured in India so far.

The rating agency said any potential credit impact of the planned investments in the semi-conductor business will depend on the details of the funding plan, which have yet to emerge.

Semi-conductor chips, or microchips, are essential pieces of many digital consumer products - from cars to mobile phones and ATM cards

Indian semi-conductor market valued at $27.2 billion in 2021Expected to grow at CAGR of nearly 19 pc to reach $64 billion in 2026

Vedanta with Taiwanese partner electronics manufacturing giant Foxconn last week signed pact to set up semi-conductor factory in Gujarat

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android