Begin typing your search...

‘Private firms must set up new manufacturing units fast’

“Our tax: GDP ratio went down to below 10 per cent in the year, we brought down tax rates, but it has now started coming up. I will not be surprised if in the current year, my tax to GDP ratio is the highest ever for direct and indirect taxes taken together,” Bajaj said at an Assocham event here.

New Delhi

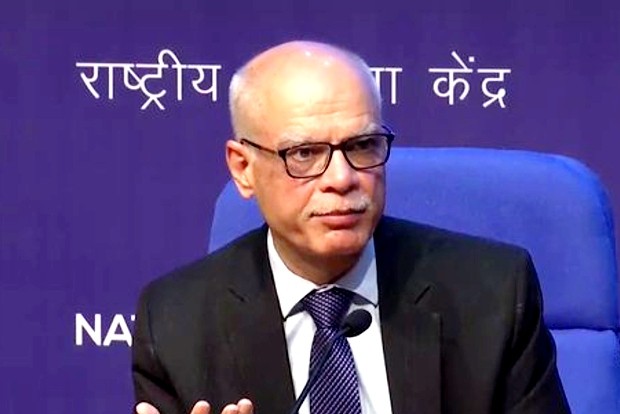

The government wants new domestic companies to set up their manufacturing units in India fast and hence the concessional tax rate of 15 per cent has been extended by a year till March 2024, Revenue Secretary Tarun Bajaj said on Friday.

Stating that direct and indirect tax collections are going up and have good buoyancy, Bajaj said it means the corporate sector is also doing well, and India’s tax to GDP ratio could be “highest ever” in the current year.

The Budget 2022-23 presented on February 1 has proposed that the concessional 15 per cent corporate tax rate would be available for one more year till March 2024 for newly incorporated manufacturing units.

While reducing the corporate tax rate in September 2019, the Centre had said any new domestic company incorporated on or after October 1, 2019, making fresh investment in manufacturing, will have an option to pay income-tax at the rate of 15 pc if they commenced their production on or before March 31, 2023.

But, these companies will not be allowed to avail of any income tax exemption/ incentive.

“Our tax: GDP ratio went down to below 10 per cent in the year, we brought down tax rates, but it has now started coming up. I will not be surprised if in the current year, my tax to GDP ratio is the highest ever for direct and indirect taxes taken together,” Bajaj said at an Assocham event here.

“The jobs will fall in place, business, taxes and income will improve. So, once that start happening, we also expect the private sector to then come in and replace the public sector in terms of its investments and take the economy forward. It is in that context only...the provision of 15 pc tax for new manufacturing companies have been extended by a year. The message is very clear that we would like you to set up your factories and manufacturing units fast, the time limit given has been extended by one more year and yes, there will be a sunset clause and then we will move to 22 pc, which is what the corporate tax rate is. ,” he said.

The Centre will settle almost all the retrospective tax cases this month, closing a chapter that plagued India’s reputation as an investment-friendly destination.

“In the month of August, we abolished the retrospective taxation and we would be settling almost all the cases this month itself.” he said at another event.

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android

Next Story