Begin typing your search...

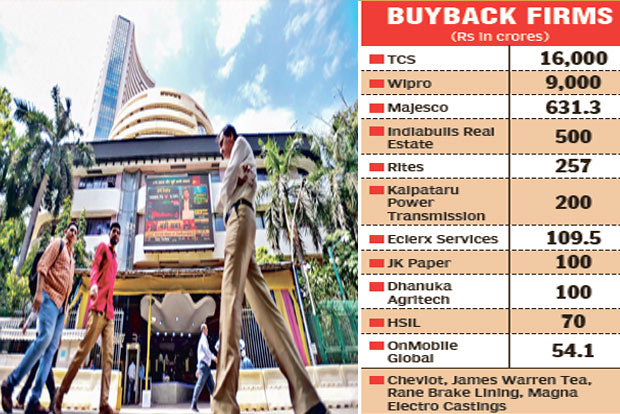

TCS, Wipro set tone for cash-rich firms to plan buybacks worth Rs 27,558 crore

Buybacks are seeing a strong trend with cash-rich companies, led by IT giants TCS and Wipro, announce buybacks worth Rs 27,588 crore to reward shareholders by returning excess cash on the balance sheets.

New Delhi

In the period, April 1 to October 15, 15 companies have announced buybacks worth Rs 27,558 crore, as per Motilal Oswal Financial Services.

Hemang Jani, Head of Equity Strategy, Broking & Distribution, Motilal Oswal Financial Services Ltd, said: “We have seen strong trend of buybacks both through tender offer and through stock exchanges as the markets have been strong. Companies having strong cash flow and no immediate capex are using this tool for the benefit of shareholders.”

Among the companies announcing buybacks are Tata Consultancy Services (worth Rs 16,000 crore), Wipro (Rs 9,000 crore), Majesco (Rs 631.3 crore), Indiabulls Real Estate (Rs 500 crore), Rites (Rs 257 crore), Kalpataru Power Transmission (Rs 200 crore), Eclerx Services (Rs 109.5 crore), JK Paper (Rs 100 crore), Dhanuka Agritech (Rs 100 crore), HSIL (Rs 70 crore), OnMobile Global (Rs 54.1 crore), Cheviot, James Warren Tea, Rane Brake Lining, Magna Electro Castings among others.

Nirali Shah, Senior Research Analyst, Samco Securities, said almost all the major listed Indian IT companies have opted the route of returning the excess cash on their balance sheet via buybacks. “The technology pack has in fact set the tone for buybacks,” she said.

Usually, buybacks occur when a company’s shares are trading at a discount and the management decides to invest in itself. Buybacks reduce the number of outstanding shares, but don’t actually change the valuation of the company. “Going forward, as the economy picks up and as growth resumes to pre-Covid levels, the number of buybacks by companies should also decline,” Shah added.

Some of the world’s most successful investors, including multi-billionaire Warren Buffett and the legendary Peter Lynch, are enthusiastic advocates of owning buyback stocks. Lynch has, in a countless number of ways, stated that buying back shares is the simplest and best way a company can reward its investors, she added.

“Given that stock buybacks are funded from company’s earnings, it is quite understandable that businesses that manage to generate consistent predictable free cash flows foray into buybacks,” Shah said. Some cash-rich PSUs are also expected to use the buy back route to return excess cash to shareholders. S Ranganathan, Head of Research at LKP Securities, said: “Second quarter has seen some good cash rich corporates announce buy back of shares to reward shareholders by returning excess cash back to shareholders. This quarter we expect few cash rich PSE to also use the buy back route to return excess cash back to shareholders.”

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android

Next Story