Begin typing your search...

Global luxury’s hidden supply chain in India

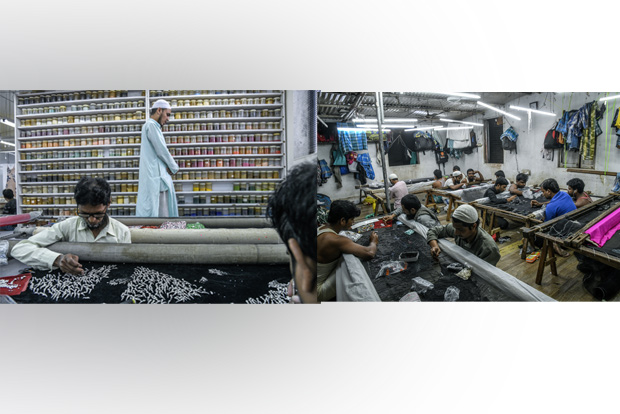

At the top of a staircase covered in dirt and sequins, several dozen artisans hunched over yards of fabric, using needles to embroider garments for the world’s most powerful fashion brands.

Chennai

They sewed without health benefits in a multi-room factory with caged windows and no emergency exit, where they earned a few dollars a day completing subcontracted orders for international designers. When night fell, some slept on the floor. They were not working for a factory employed by fast fashion brands: companies whose business model is premised on producing trendy clothing as cheaply as possible and whose supply chain issues came under scrutiny in 2013. That was when the deadliest garment industry disaster in history, the Rana Plaza factory collapse, killed more than 1,100 Bangladeshi workers.

Their products were destined for Dior and Saint Laurent, among other luxury names. Unknown to most consumers, the expensive, glittering brands of runways in Paris and Milan also indirectly employ thousands of workers in the developing world. In Mumbai, scores of ateliers and export houses act as middlemen between the brands and highly skilled artisans, while also providing services like design, sampling and garment production.

As with fast fashion retailers, many luxury brands do not own all of their own production facilities, and instead contract with independent factories to make their garments or embroider them. And like fast fashion, they too have woken up to potential dangers with that system. In 2016, a group of luxury houses introduced the Utthan pact, an ambitious and secretive compliance project aimed at ensuring factory safety in Mumbai and elevating Indian embroiderers. Among the signatories were Kering (owner of labels including Gucci and Saint Laurent); LVMH Louis Vuitton Moet Hennessy (owner of Fendi and Christian Dior); and two British fashion houses, Burberry and Mulberry. The pact had an initial three-year timeline but was not legally binding.

Yet during visits to several Mumbai factories, and in more than three dozen interviews with artisans, factory managers and designers, The New York Times found that embroiderers still completed orders at unregulated facilities that did not meet Indian factory safety laws. Many workers still do not have any employment benefits or protections, while seasonal demands for thousands of hours of overtime would coincide with the latest fashion weeks in Europe.

Several factory owners said that membership in the pact meant investing in the costly compliance standards outlined by the Utthan pact, while brands simultaneously drove down what they would pay for orders. “Given the product prices, there is a sense that the luxury brands must be doing it right, and that makes them immune to public scrutiny,” said Michael Posner, a professor of ethics and finance at the Stern School of Business at New York University. “But despite the price tags for luxury brand goods, the conditions in factories across their supply chains can be just as bad as those found in factories producing for fast fashion retailers.

When contacted for comment, luxury brands that were Utthan signatories largely highlighted the broader improvements made by the implementation of the pact, rather than focusing on continuing issues and accusations.

— The writers are journalists with NYT© 2020 (The New York Times)

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android

Next Story