Begin typing your search...

GST regime to stabilise in next 18 months, three slab structure in the offing: Niti VC

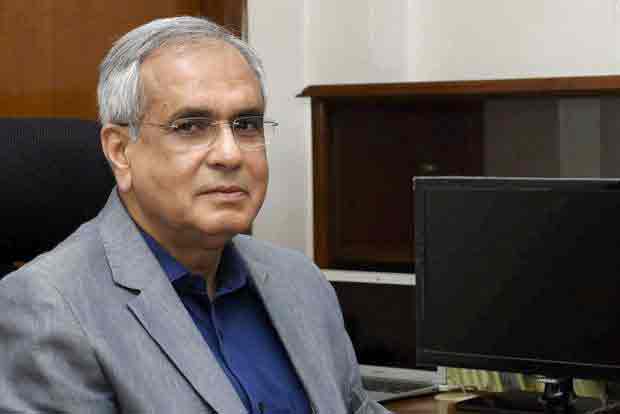

The Goods and Services Tax (GST) regime would get stabilised in the next 18 months, Niti Aayog Vice Chairman Rajiv Kumar said on Friday.

Bengaluru

“Give us time and you will see that in the next 18 months, GST will get stabilised, and this is where I think your (CAs) role is critical,” he said while addressing the Southern Regional Conference of the Institute of Chartered Accountants of India here.

“Unfortunately, some of you are trying to scare investors away from GST rather than helping them.

I think it is rather unfair,” he added. Kumar said if CAs do not extend cooperation, India will not be able to erase dualism in terms of organised and unorganised sectors, which is not good for the economy.

Kumar said tax rates under GST will rationalise into three slabs, from five at present.

“In times to come, tax rates under Goods and Services Tax will converge into three slabs – 0, 12 and 28 per cent,” he said. Kumar said to expect one tax rate under GST was impractical, given the size of the country which is equal to all European nations from Russia to UK put together.

“Also, there are varied cultures and business ethics followed by different states, and hence it is not feasible to have one tax rate under GST. Hence, it was necessary to have those multiple rates,” he said.

GST more primitive than VAT.

Meanwhile, West Bengal FM Amit Mitra said, the hurried launch of GST without proper infrastructure has made the indirect tax system more “primitive” than the VAT regime. The Centre is using ledger for manual record of refunds due to lack of interface between the GST network and customs electronic date interchange as well as the Directorate General of Foreign Trade. Owing to the GST system, exporters were unable to get refunds and at least 10-15 per cent of their working capital was locked. “There are job losses due to less business in gems and jewellery sector, I am also deeply concerned about SME and unorganised sectors which are cash-based,” he said.

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android

Next Story