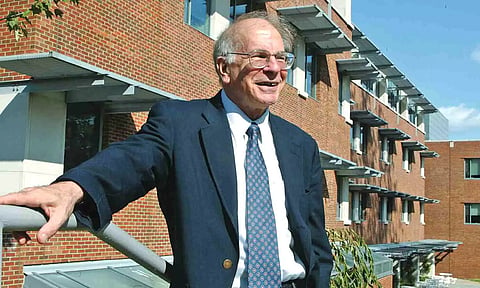

Daniel Kahneman, who plumbed psychology of economics

NEW YORK: Daniel Kahneman, who never took an economics course but who pioneered a psychologically based branch of that field that led to a Nobel in economic science in 2002, died Wednesday. He was 90. His death was confirmed by his partner, Barbara Tversky.

Professor Kahneman, who was long associated with Princeton University and lived in Manhattan, employed his training as a psychologist to advance what came to be called behavioral economics. The work, done largely in the 1970s, led to a rethinking of issues as far-flung as medical malpractice, international political negotiations and the evaluation of baseball talent, all of which he analyzed, mostly in collaboration with Amos Tversky, a Stanford cognitive psychologist who did groundbreaking work on human judgment and decision-making. (Ms. Tversky, also a professor of psychology at Stanford, had been married to Professor Tversky, who died in 1996. She and Professor Kahneman became partners several years ago.)

As opposed to traditional economics, which assumes that human beings generally act in fully rational ways and that any exceptions tend to disappear as the stakes are raised, the behavioral school is based on exposing hard-wired mental biases that can warp judgment, often with counter-intuitive results.

“His central message could not be more important,” the Harvard psychologist and author Steven Pinker told The Guardian in 2014, “namely, that human reason left to its own devices is apt to engage in a number of fallacies and systematic errors, so if we want to make better decisions in our personal lives and as a society, we ought to be aware of these biases and seek workarounds. That’s a powerful and important discovery.”

Professor Kahneman delighted in pointing out and explaining what he called universal brain “kinks.” The most important of these, the behaviourists hold, is loss-aversion: Why, for example, does the loss of $100 hurt about twice as much as the gaining of $100 brings pleasure? Among its myriad implications, loss-aversion theory suggests that it is foolish to check one’s stock portfolio frequently, since the predominance of pain experienced in the stock market will most likely lead to excessive and possibly self-defeating caution.

Loss-aversion also explains why golfers have been found to putt better when going for par on a given hole than for a stroke-gaining birdie. They try harder on a par putt because they dearly want to avoid a bogey, or a loss of a stroke.

Mild-mannered and self-effacing, Professor Kahneman not only welcomed debate on his ideas; he also enlisted the help of adversaries as well as colleagues to perfect them. When asked who should be considered the “father” of behavioral economics, Professor Kahneman pointed to the University of Chicago economist Richard H. Thaler, a younger scholar (by 11 years) whom he described in his Nobel autobiography as his second most important professional friend, after Professor Tversky.