WASHINGTON: Last year, a start-up called Party Round announced itself with a flurry of memes. For months, amateur investors had been going gangbusters, buying up stocks, cryptocurrencies and digital art known as NFTs. But getting in early on the next hot tech start-up was still a professional’s game. Party Round’s big idea was to let start-ups easily raise money from family members, former co-workers, bosses and others in their networks.

“Invest in friends,” Party Round’s tagline urged before its launch. For a while, it was fun. The tech industry soared to record heights during the pandemic, and Party Round rode the frenzy with self-aware marketing stunts that poked fun at and celebrated start-up culture. There was a venture-capital-themed puzzle with corresponding NFTs and a game called “Burn the Runway,” where players killed start-ups by spending all their money on silent retreats and Teslas. In one stunt, Party Round paid a woman $50,000 to quit her job at Facebook and start a company focused on cryptocurrency literacy.

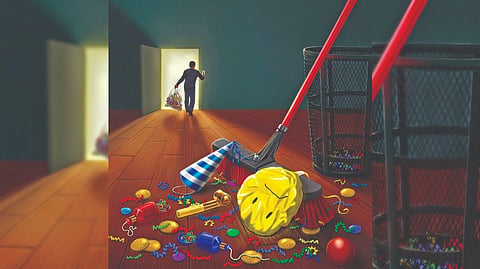

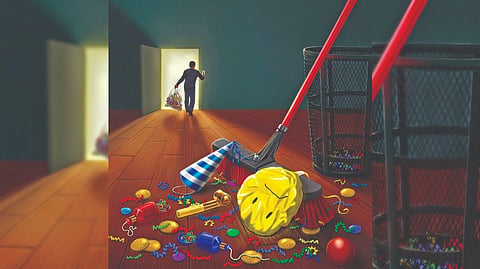

Then the party abruptly ended. Russia invaded Ukraine. Inflation soared. Tech stocks crashed. Crypto crashed harder. Funding dried up. start-ups began laying off workers and cutting costs. Investors who had cheered on the exuberant market switched to ominous warnings about a downturn. The woman with the crypto start-up got a job.

So Party Round adjusted. Making jokes about the absurdities of tech culture is fun when everyone is getting richer by the day, but they don’t land the same when everyone is getting laid off. “Party Round is now Capital,” the company announced this month.

With the new name, the company moved into banking services. It plans to trade absurdist marketing campaigns for something more practical — a coworking space that its customers can use in New York.

“The Capital brand is definitely an evolution,” said Jordi Hays, the company’s CEO. “It’s more mature, it’s more sustainable.”

It is one of a growing number of signs that the start-up world’s season of unbridled euphoria is really, truly over. Technology was largely immune to the pandemic’s economic devastation, and many in the industry had hoped the current slump would be a momentary reset. But after months of funding declines, layoffs and cost-cutting, the realisation that start-ups are stuck in a sustained, gloomy, no-fun downturn has finally set in. “Founders are starting to see the writing on the wall,” said Angela Lee, a finance professor specialising in venture capital at Columbia Business School. For years, market observers have predicted a downturn that never arrived, she said. Now, “we’re finally right.”

Between July and September, start-ups around the world raised $81 billion, a 53% drop from the same period a year ago, according to Crunchbase. It is the largest such decline since the site began tracking funding in 2007. More than 700 start-ups have laid off 93,000 workers this year, according to Layoffs.fyi, which tracks job cuts at start-ups. Over the past two weeks, weaker quarterly results at big tech companies, including Snap, Meta, Amazon and Microsoft, sent the broader tech industry spiralling further downward.

The term “party round” itself once had a bad reputation in tech. It describes instances in which a start-up raises small amounts of cash from a large number of investors. If things went badly, industry leaders argued, none of the company’s many investors would step up and help.

“No single investor cares enough,” Sam Altman, a tech investor and founder, wrote in a blog post criticising the practice in 2013.

“Everybody assumes that somebody else is playing parent,” Mark Suster, an investor at Upfront Ventures, wrote in 2011.

But the last decade of tech prosperity, growing valuations and an expanding pile of capital earmarked for start-ups has changed attitudes, taking the party round from stigmatised to something to brag about. And new entrants like celebrities, athletes, mid-level tech execs or your allergist all sought to join the party.

Services with names like Pump and Cabal sprang up to help founders manage their expanding pools of investors. And of course, Party Round, which raised $7 million in funding from more than 50 investors last year, valuing it at $50 million.

“The best companies in every single category are all doing quote unquote party rounds,” Hays said in an interview when Party Round opened last year. AbstractOps, a software provider, announced in February that it had raised $8 million from more than 300 individual investors. In a blog post, its CEO, Hari Raghavan, said the investors would be evangelists for the company. “They’re the Silicon Valley equivalent of celebrity influencers!” he wrote. In a message, Raghavan said his array of angel investors had been helpful, but adding professional investors to the company’s board earlier could have helped with accountability.

“We might have confronted harder questions sooner, ahead of — instead of during — a market downturn,” he said. At Party Round, the people in charge of the viral marketing gags and memes at the company are now making “Nike-style” promotional videos about its customers. But Hays said he expected to revive the brand at some point.

Like many in tech, he saw how quickly the industry recovered from the initial shock of the pandemic in 2020. Now even with the gloom, venture capital firms are sitting on enormous sums of capital. That money will have to be invested in start-ups.

“Eventually,” Hays said, “we’ll come back to euphoria.”

Erin Griffith is a journalist with NYT©2022

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android