CHENNAI: Millennial investors, known for their higher risk appetite and asset-light financial approach, are increasingly investing in Indian commercial real estate (CRE). As many as 53 per cent of NRI investors are millennials, reveals the second edition of Neo-realty Survey by MYRE Capital, which assessed the investment appetite of around 5,000 NRIs across 13 countries.

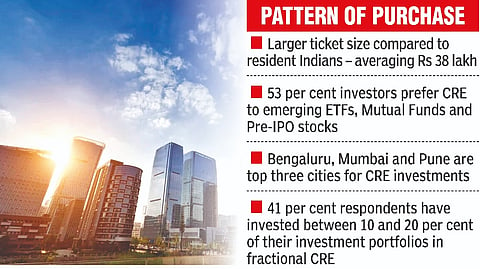

CRE growth drivers for NRI investors include passive Income for family, portfolio diversification, lack of other safe alternatives, tax-efficient returns among others. Properties in Bengaluru, Mumbai, Pune are the top three investment hubs for NRIs, wherein office spaces remain the most sought-after asset and school spaces emerge as a new CRE assets.

As per the survey, a whopping 53 per cent of the NRI investors choose CRE as their favourite investment vehicle over ETFs (21%), Mutual Funds (19%) with the average ticket size for an NRI being higher, at Rs 38 lakh compared to a resident CRE investor. Interestingly, 82 per cent of the NRI investors did not have any previous investments in India, owing to the accessibility issues, lack of transparency and trust.

The influencing factors to begin their first Indian investment in CRE have been the transparency, competitive returns, tech-enabled experience (including virtual tours for investors who can’t visit the property, digital on-boarding and performance tracking, real time updates), and asset management.

MYRE Capital’s first edition of the survey in 2021 had revealed that more CAs and lawyers in India aspire to invest in CRE. However, the second edition’s NRI investor profile shows a broader investor base with increasing traction and participation from engineers, tech experts, and consultants. This can be validated by increasing demand and salary structure for tech and consultancy jobs outside India, giving more disposable income at the hands of these professionals.

Originally hailing from Bengaluru and Mumbai (a combined 45 per cent of the respondents), investors have shown a geographical interest in investing in cities they belonged to. Bengaluru has been home to

India’s largest IT corridor providing office spaces for some of the leading MNCs - given the pandemic situation, globally firms are accelerating the transition of processes to a more digital oriented approach.

Bengaluru has witnessed continued increasing demand from MNC’s and has been able to sustain market growth whilst keeping vacancies in single digits.

MYRE Capital’s founder-CEO, Aryaman Vir said, “We conducted the survey to understand if the new-age investor faced the same entry barrier as the GenX investor. We were pleasantly surprised to find investors are now keen on investing in assets such as office space, student housing, and schools. Nearly 40 per cent of our NRI user base are women, we believe increasing awareness and access to Grade-A properties will make more NRIs explore this asset class. Since millennials and high salaried senior professionals comprise a large subset of these NRI investors, there is a natural inclination to invest in fractional CRE which is easy to manage versus any other form of traditional real estate ownership.”

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android