RBI forecasts economic growth at 6.4 pc in FY24

The RBI is mandated to keep inflation at 4 per cent with a margin of 2 per cent on either side.For the next fiscal, the RBI projected a growth rate of 6.4 per cent.

NEW DELHI: The RBI on Wednesday projected India’s economic growth to slow down to 6.4 per cent in FY24 from 7 per cent in the current fiscal, citing risks from geo-political tension and tightening global financial condition.

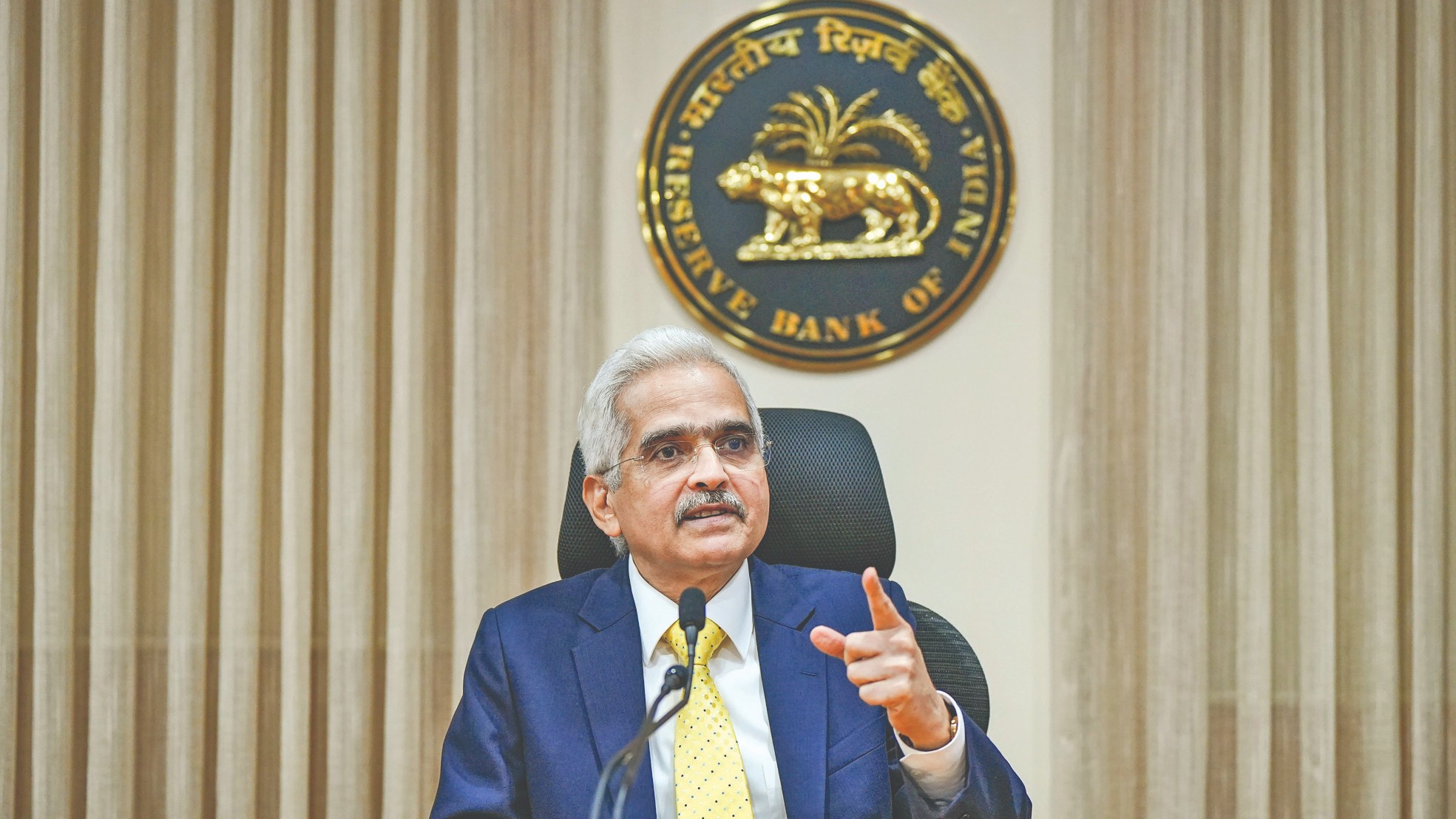

Announcing the bi-monthly monetary policy, Reserve Bank of India governor Shaktikanta Das said the RBI’s internal survey says manufacturing, services and infrastructure sector firms are optimistic of the business outlook.

However, protracted geo-political tension, tightening global financial conditions and external demands continue as downside risks to the domestic outlook, he noted.

“The real GDP growth for 2023-24 is projected at 6.4 per cent,” Das said.

In 2023-24, the growth in the June and September quarter is projected at 7.8 per cent and 6.2 per cent, respectively. In the December and March quarter, the GDP growth is estimated at 6 per cent and 5.8 per cent, respectively.

“Monetary policy will continue to be agile and alert to effectively address challenges to the economy,” Das said.

Several economists and rating agencies have projected India’s real GDP growth to slow to between 6-6.5 per cent in the next fiscal.

He also said the Current Account Deficit (CAD) is expected to moderate in second half of 2022-23 from 3.3 per cent of GDP in April-September mainly due to moderation in imports.

CAD, a key indicator of the external sector, had widened to 3.3 per cent of GDP in first half of 2022-23 from 0.2 per cent in the comparable period of 2021-22 on the back of a sharp increase in the merchandise trade deficit.

“The situation has shown improvement in Q3:2022-23 as imports moderated in the wake of lower commodity prices, resulting in narrowing of the merchandise trade deficit,” the Governor said while announcing the last bi-monthly monetary policy of current fiscal year.

Further, Das said services exports rose 24.9 per cent year-on-year in the third quarter of 2022-23, driven by software, business and travel services. Global software and IT services spending is expected to remain strong in 2023.

Also, remittance growth for India in April-September 2022-23 was around 26 per cent – more than twice the World Bank’s projection for the year.

This is likely to remain robust owing to better growth prospects of the Gulf countries, the Governor said and added that the net balance under services and remittances is expected to remain in large surplus, partly offsetting the trade deficit.

“The CAD is expected to moderate in H2:2022-23 and remain eminently manageable and within the parameters of viability,” he said.

On the financing of CAD, the Governor said the net foreign direct investment (FDI) flows remain strong at $22.3 billion during April-December 2022 ($24.8 billion in the corresponding period last year). Foreign portfolio flows have shown signs of improvement with positive flows of $8.5 billion during July to February 6, led by equity flows. Foreign portfolio flows are, however, negative during the financial year so far.

Das said net inflows under non-resident deposits increased to $3.6 billion during April-November 2022 from $2.6 billion a year ago, boosted by the Reserve Bank’s July 6, 2022 measures.

He further said foreign exchange reserves have rebounded from $524.5 billion on October 21, 2022 to $576.8 billion on January 27, 2023, covering around 9.4 months of projected imports for 2022-23.

The country’s external debt ratios are low by international standards, he added.

India’s external debt/GDP ratio fell from 19.9 per cent in March 2022 to 19.2 per cent in September. The debt service ratio declined from 5.2 per cent in 2021-22 to 5 per cent at the end of September 2022.

One client won’t affect Indian banking system, says Das on Adani row

An individual client - Adani Group - will not bring down the Indian banking system as the country’s banking sector is resilient and strong, Das said.

Queried about the Indian bank’s exposure to the Adani Group and the comments of credit rating agencies, the governor said the Indian banking system is strong and an individual client will not affect it.

Das said the banks lend money based on fundamentals of the project and not based on the market capitalisation of the company.

He also said the credit appraisal methods of Indian banks have improved.

According to him, two years ago, the RBI rationalised the large exposure norms for banks and the norms are being complied. Further, RBI deputy governor Mahesh Kumar Jain said the exposure of banks is based on underlying assets and the exposure of the banking sector against shares is insignificant.

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android