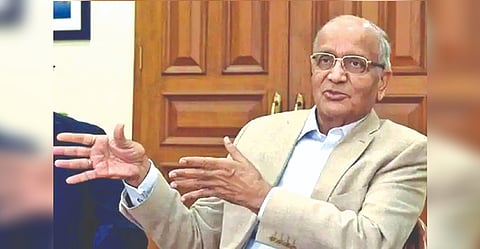

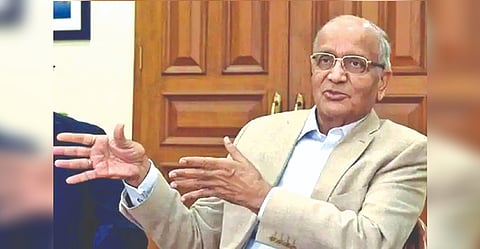

NEW DELHI: The regulatory burden is the highest on small cars, a key segment of the Indian automobile industry and having a uniform tax structure across all segments of vehicles will not augur well for the sector growth, as per Maruti Suzuki India (MSIL) chairman RC Bhargava.

He also said India’s economic growth rate could be higher if the manufacturing sector grows fast, which ‘unfortunately’ has remained a laggard despite the best efforts of the Narendra Modi-led government at the Centre due to implementation gaps at the ground level.

“The burden of regulatory changes on the small cars is far higher than the regulatory burden on big cars and that is changing the whole market behaviour.

People who are buying small cars are not buying small cars in near the same numbers. Personally, I think it’s not a good thing, either for the car industry or the country,” Bhargava said in an interaction.

For the healthy growth of the automobile industry, there must be a steady increase in the number of new customers in the car park. The base of ownership of cars must be increasing every year. Only then when the whole pyramid becomes a larger one, which is able to balance itself, he added.

“I don’t see that as becoming an inverted pyramid and the car industry becomes an industry where in India there is hardly any growth in the small segment and all the growth takes place in the higher segments. So, that factor has to be kept in mind, the regulatory effect on the car, and that’s one argument for not having a uniform rate of tax on all small and big cars,” Bhargava asserted.

He was responding to a query on his views about having a uniform tax rate across all segments of automobiles.

At present, automobiles are taxed at 28 per cent GST with additional cess ranging from 1 per cent to 22 per cent depending on the type of vehicle. Cars imported as completely built units (CBU) attract customs duty ranging between 60 per cent and 100 per cent, depending on engine size and cost, insurance and freight (CIF) value being less or above $40,000.

Bhargava, however, said for electric cars, GST has been kept at 5 per cent “whether it’s a small electric car or big electric car. There’s no differential tax rate there. So, there is already that uniform taxation happening”.

He also lamented that the auto sector continues to be heavily taxed, which in a way has affected the growth of the industry.

“Throughout our history,” he said all motor vehicles “have been in the highest tax brackets”.

In response to a query on the impact of clarification on the definition of SUVs for taxation purposes, he said it “confirms that they should charge 22 per cent (cess) when four conditions are met, which puts it into the 50 per cent kind of tax bracket”.

“You can’t grow an automobile industry with 50 per cent taxation. Where in the world has an industry like automobiles grown with 50 per cent taxation, but it’s the wisdom of the policymakers and the political leadership,” Bhargava noted.

He said compared to developed markets like Europe and Japan, where per capita income is far higher, taxes on cars in India are much higher. “Now, somebody needs to think about that, should cars be charged more than the average rate of taxation...? If it is, then we are, in some way, accepting the thing that cars or luxury products should be taxed more than non-luxury products, which is the old socialist way of thinking and taxation,” he said.

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android