Begin typing your search...

The Domino Effect: Record gold price to spur new mine exploration

Gold prices have risen more than 20% this year to touch all-time highs, as low yields and central bank stimulus drive investors toward the precious metal.

Chennai

The yellow metal soared to a record high of $1,944.71 per ounce on Monday, well above its previous record of $1,921.18 seen in 2011 — with demand also supported by worsening US-China relations and worries of delayed and uneven economic recovery amid rising coronavirus cases in several parts of the world, which have reinforced gold’s safe-haven appeal. Gold has been the best-performing major asset class this year.

The collapse in interest rates and bond yields has made holding gold attractive, Adrian Ash, director of research at investment firm BullionVault, said. He added that “rising inflation expectations, driven by unprecedented peacetime (fiscal) deficits plus central bank stimulus,” make the precious metal, which is considered as a hedge against inflation, an appealing alternative to cash or credit investments.

Gold ETFs on a tear

The demand for the precious metal has mainly been driven by record inflows in gold-backed exchange traded funds (ETFs) — investment funds that trade like stocks and replicate whole indices — which offset falling demand for physical gold in key markets such as China and India.

Gold ETFs attracted inflows of 734 tons — equivalent to $39.5 billion — in the first half of this year, which pushed global holdings in these products to new all-time highs of 3,621 tons, World Gold Council data showed. Gold ETF inflows in the first six months have surpassed the largest annual gain of 646 tons seen in 2009. “The factors that have driven demand for gold in the first half of the year are not going to change much in the second half,” John Reade, chief market strategist at the World Gold Council, said.

Higher exploration budgets

The surge in gold prices would allow gold miners to loosen their purse strings and spend on boosting production, possibly on the exploration of new mines, after years of cost cutting amid declining prices.

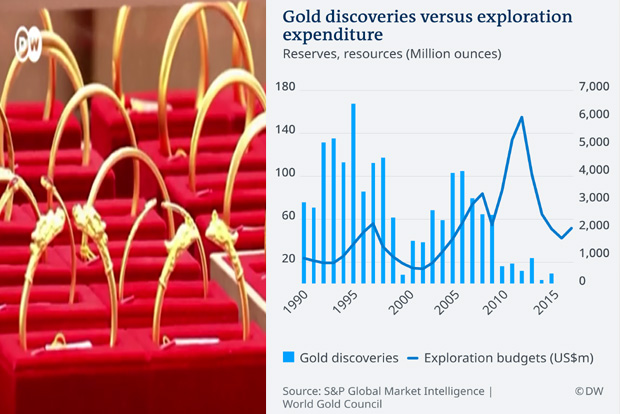

Global exploration budgets have more than halved from their 2012 highs of around $10 billion. In the past few years, gold miners have turned their focus away from growing production at any cost to focusing on economic metrics like free cash flow generation in the face of investor pressure.

They have also struggled to discover new deposits to replace the lost production, prompting several experts and industry magnates to forecast a perpetual decline in gold production from its current peak. The rate of gold mine discoveries has declined over the past three decades, World Gold Council figures show.

Among the new discoveries, there have been hardly any that experts call “world class” deposits. These are typically large high-grade deposits with over 5 million ounces of gold reserves that can be turned into profitable mines capable of producing over 250,000 ounces of gold. The average grade of the new gold deposits — the amount of gold that can be extracted per ton — has also been declining.

Looking beyond Australia

But there are others who blame low gold prices for fewer discoveries, while stressing that the world is not running out of gold. They say higher prices and technological advancements would help push miners to explore new frontiers for the precious metal, including the seabed and possibly even asteroids. Currently, Australia, Canada and the US absorb 40% of global spending on exploration. Miners could now potentially turn to riskier, less explored countries in Latin America and Africa. Mining majors have stayed away from exploring for greenfield mines over past decade, focusing instead on older, known deposits, the so-called brownfield projects.

They have relied on junior miners or smaller miners to search for greenfield mines. But the smaller miners have struggled to convince investors to take a punt on them. That seems to be changing with the rise in gold prices, which is prompting increasing investor interest in the juniors.

— This article has been provided by Deutsche Welle

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android

Next Story