Chennai

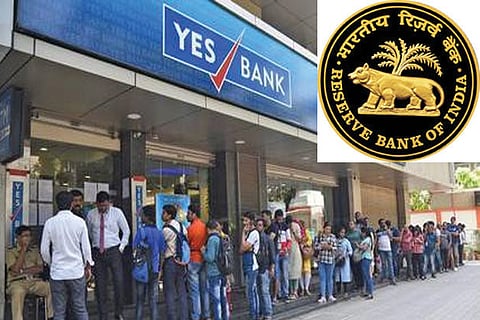

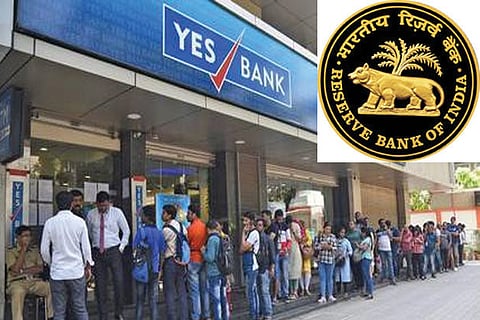

But could the RBI have prevented this massive financial debacle by the country’s erstwhile fifth largest lender?

Yes Bank was started in 2005 by Rana Kapoor and his partner Ashok Kapur. Ashok Kapur was unfortunately killed in the 26/11 attacks in Mumbai, after which Rana Kapoor took charge of the bank by himself, and by all accounts, operated as almost a sole decision maker. From 2008 to 2018, the bank’s net profit grew by 35 per cent, which on paper made it a very successful bank, but it was also around then that Yes Bank began living up to its name in a manner that started to cause concern in the banking circles. The lender became known for never turning down a loan request to any company, notwithstanding the fact that they had been rejected by all other banks. Some of these included Cafe Coffee Day, Dewan Housing and Jet Airways.

It was also in 2018 that despite the so-called profit shown by the bank under the stewardship of Rana Kapoor, the RBI turned down a proposal to extend his tenure by another three years. Although there was no official explanation, unconfirmed reports stated there were serious compliance issues reported. Another red flag was the fact that in 2018-2019, Rana Kapoor also started dumping his shares – shares that he had once described as ‘diamonds’.

So it’s clear that the RBI was aware almost two years ago that there were issues with the way Yes Bank was being run. Now, in 2020, after the massive collapse of Yes Bank, the SBI is on a rescue mission – with the taxpayer’s money. If one considers the fact that our tax money, which should ideally be used to build roads, improve infrastructure, run more schools and hospitals, is being used to bail out a bank which was run to the ground by a businessman who basically used public money to bolster bad decisions and fund his personal lifestyle, the public outrage is understandable.

This brings us back to RBI’s role and responsibility in this debacle. Should they have waited two years to act against Rana Kapoor? Shouldn’t depositors have been warned in advance? Could the CBI and the Income Tax department been brought in much earlier to investigate the ‘compliance’ issues?

But the more pertinent question is: Who looks out for the taxpayers and the small depositors when the main regulator, the RBI, looks away?

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android