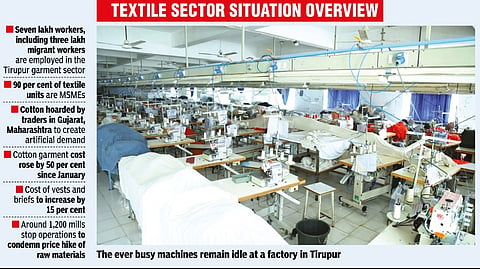

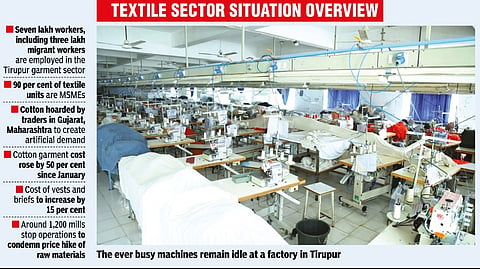

COIMBATORE: Recovering from Covid-19 impact, the Tirupur textile sector’s growth zoomed high, much faster than expected due to multiple factors, including general aversion globally towards Chinese brands.

Things too worked out in our favour as international buyers switched loyalty towards India, Bangladesh and Vietnam. “The business volume till last quarter of the financial year was going good as exports clocked Rs 34,000 crore in the last financial year. But, the slippage has set in now due to the fear psychosis gripping the European market following war in Russia and yarn price hike in India. Currently, the orders from overseas market have dropped by 30 to 40 per cent,” said Raja M Shanmugam, president of Tirupur Exporters Association (TEA)

After having lost its share in the international market, China is now offering better prices than any other competing countries towards regaining its lost hold. “Since China has a buffer stock of cotton to use in times of crisis, they give better prices for their produce. So, there is every possibility of global brands going back to China because of the price factor. If issues concerning the textile sector are not addressed immediately, then it would definitely work out to the advantage for China,” he added.

Among the two major factors attributed for the downward trend of the textile sector is hoarding and a steep increase in yarn price. Yarn prices increased by Rs 70 in the last two months alone and raised overall from Rs 200 to Rs 450 over the last 18 months. One candy of cotton which was sold at Rs 42,000 then, now costs Rs 1.05 lakh.

Such an abnormal increase in yarn and cotton prices were unforeseen by the textile industries. “Until 2019 and 2020; yarn prices normally hovered with an increase or decrease by only upto Rs 10 a month. It then offered a convenience for manufacturers to absorb simple price variations within the profit margin. But, now the cost difference, while at the time of taking orders and by the time of delivery gets drastically high and unaffordable for manufacturers. Making frequent revision in pricing forces the international clients to look for alternative options,” said MP Muthurathinam, president of Tirupur Exporters and Manufacturers’ Association (TEAMA).

Currently, the industrial units in Tirupur are working to complete the existing overseas orders in hand, while the domestic business, which comes to around Rs 30,000 crore annually, has also almost come to a grinding halt.

Hoarding is another major reason for yarn price rise. “Hoarding mostly happens in Maharashtra, Gujarat and Andhra Pradesh. Unless cotton is brought under the Essential Commodities Act, it may be difficult to crack down on hoarding. The hoarders operate as a big lobby from Mumbai. Around 42 lakh bales of cotton are suspected to be hoarded and we have been demanding the government to unearth them and bring them to use, said industrialists.

Since China has a buffer stock of cotton to use in times of crisis, they give better prices for their produce. So, there is every possibility of global brands going back to China because of the price factor Raja M Shanmugam, president TEA

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android