Chennai

Presenting his first budget, he said: "The lack of adequate beneficiary data is the fundamental limitation in our government's ability to efficiently implement welfare schemes in order to improve social and economic justice."

"A cross-departmental initiative to link all available government data sources to better understand the true economic status of all citizens and households will be undertaken. This foundational effort which will help improve the delivery of many tens of thousands of crores worth of subsidies," he added.

Pointing out what cannot be measured cannot be improved, Rajan said the government will implement smart metering for all public utilities in the State.

As a part of data-centric governance, he said E-procurement will be mandatorily adopted across all procuring entities. A separate E-procurement portal will be created for the state government to enhance transparency in procurement.

The entire workflow process of all engineering departments including updated standard data book and schedule of rates, planning and design, estimate preparation, tendering, measurement of works, payment of bills and recording completion will be fully electronically enabled to increase efficiency and transparency.

With over 2.05 lakh hectares of state government land encroached, an advanced Government Land Management System, which will contain full details of all government lands, will be created in order to improve management of the public land. This will prevent the state's assets from being used inefficiently, misused, or even diverted, Rajan said.

According to him, a Litigation Risk Management System will be established which will monitor all high-risk litigations relating to taxation, land matters, personnel matters and procurement issues to ensure that the public interest is effectively protected, and resources accrue to the government without delay.

"The Litigation Management System will be overseen by an experienced team of retired judges and senior legal experts," he said.

Rajan also said multiple data points indicate that government funds are often shifted to accounts outside the view of the treasury system.

"Upon assuming office, this government initiated a dual-track survey to identify such funds - through government departments and agencies and by banks holding such accounts. The initial assessment reveals substantial unutilised funds," he said.

The government will establish a special task group under a senior officer of the Finance Department to fully reconcile the accounts and identify funds which have lapsed and which can still be utilised, Rajan said.

He said all Audit Departments functioning in the government will be brought under the Finance Department and be integrated seamlessly to ensure that internal audit functions are effectively carried out across all Government departments and agencies.

TN to set up advisory council to frame Federal Fiscal Model

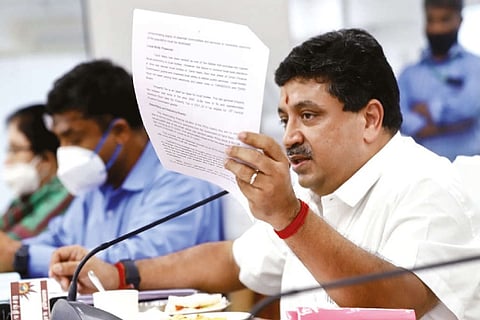

Tamil Nadu Finance Minister Palanivel Thiaga Rajan on Friday said the state government will set up an advisory council of tax law and revenue experts to develop a "Federal Fiscal Model".

Presenting the budget for 2021-22 - the DMK government's first, Rajan, pointing out the inequities in the sharing of revenues between the Centre and the states, said: "To address these issues comprehensively, as well as propose a new and comprehensive approach, this government will establish an advisory council to develop a Federal Fiscal Model with renowned experts on legislation involving revenue and taxation (including GST)."

He said the dilution in the spirit of federalism is more apparent in the taxation of petrol and diesel at the pump.

"The overall Union levies on petrol were increased from Rs 10.39 per litre in May 2014 to Rs 32.90 per litre today. Similarly, the levies on diesel were increased from Rs 3.57 in May 2014 to Rs 31.80 today," he said.

On the other hand, the Centre reduced the basic excise duty and as a result in 2020-21, the revenue to the Union Government from petrol and diesel went up by 63 per cent from the revenue in 2019-20, but the share of the states declined sharply.

"Hence, the onus of providing relief to the final consumers of petrol and diesel lies with the Union government," he added.

Rajan also said the Comptroller and Auditor General of India (CAG) has pointed out that the Union government cesses levied for a specific purpose have not been fully utilised for the intended purpose, and surcharges which are meant for a limited time have continued almost indefinitely.

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android