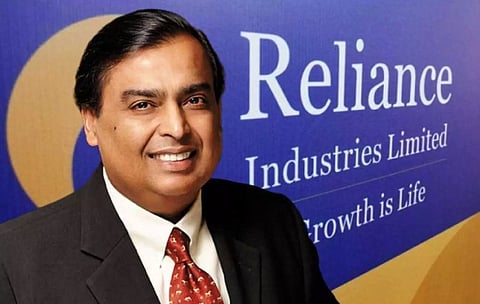

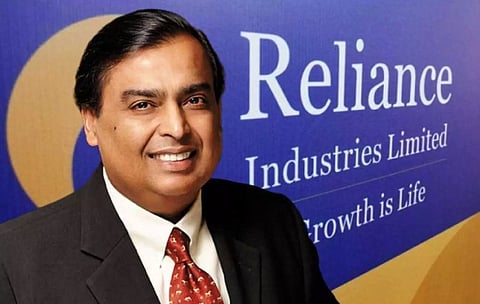

NEW DELHI: Billionaire Mukesh Ambani’s Reliance is the best-positioned player in the $150-billion Indian e-commerce market ahead of Amazon and Walmart due to it owning the potent combination of largest retail store network, dominant telecom operations and strong digital media, an analyst said.

In a new report, Bernstein Research said India is evolving into a three-player market with Amazon, Walmart and Reliance.

The conventional retail business model starts out either offline (Walmart) or online (Amazon).

“Given distribution challenges and India’s propensity to ‘skip a generation’ in most technologies, we believe the Indian e-commerce market will be different. An integrated model (offline plus online plus prime), strong distribution capability and superior cost advantage (against online players) are required from the start,” it said. Reliance Industries is building the largest digital ecosystem in India. Its telecom arm Jio has 430 million mobile subscribers, its retail arm has 18,300 retail stores in India ($30 billion in sales), and its digital mix is scaling up 17-18 per cent ($6 billion, e-commerce).

“It’s a disruptive playbook - integrate offline + online + prime makes it the strongest competitor to Amazon/Walmart,” Bernstein said.

Reliance has 400,000-plus people in its retail business. It has, since January this year, hired about 69,000 new employees to replenish turnaround (about 66,500 employees exited the company). The turnaround in the company is lower than the 30-40 per cent annual churn seen in organised retail in the country.

It has also laid off some purely on performance-related issues. Close to 570 have been handed pink slips after failing to improve performance and serving notice period post-April 2023.

The sacking because of performance-related issues is less than 0.14 per cent of the entire workforce.

India is one of the few large and under-penetrated e-commerce markets. The market is expected to reach $150 billion by 2025, with online penetration doubling in the next 5 years. Flipkart ($23 billion gross merchandise value or GMV) and Amazon ($18-20 billion GMV) lead on scale with about 60 per cent market share. Reliance is No 3 ($5.7 billion e-commerce sales) driven by attractive categories of fashion (Ajio) and JioMart (e-grocery).

All three players are focused on - Get Big (scale), Get Close (customer loyalty) and Get Fit (profitability).

“We believe Reliance Retail/Jio is the best-positioned player in the largest and fastest-growing e-commerce market. The advantages of its retail network, mobile network, digital ecosystem and ‘home field advantage’, it will likely claim the lion’s share of the $150 billion-plus e-commerce marketplace,” it added.

STRONG ACROSS VERTICALS

SCALE ADVANTAGE