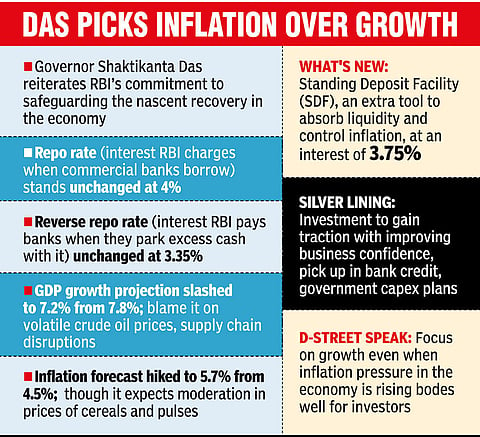

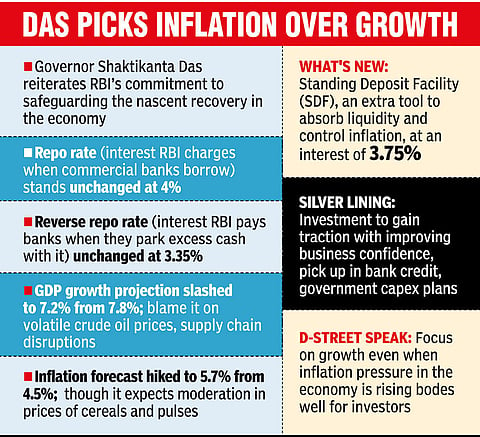

MUMBAI: RBI’s six-member Monetary Policy Committee voted to hold the benchmark repurchase or the repo rate at 4 per cent, Governor Shaktikanta Das said. The panel decided to stick to an accommodative stance “while focussing on withdrawal of accommodation to ensure that inflation remains within the target going forward while supporting growth”.

This essentially means that the RBI is providing clear signals on the exit from accommodative monetary policy in the near future while retaining the accommodative stance for now along with the status quo on the repo rate. Das said the priority for the last three years was growth followed by inflation and now it has been reversed.

As it now anticipates a much faster rise in inflation than earlier - the inflation forecast has been raised to 5.7 per cent for the fiscal that started on April 1, up from its 4.5 per cent estimate in February. The RBI also lowered the economic growth forecast to 7.2 per cent for the current 2022-23 fiscal from the previous outlook of 7.8 per cent. This compares to real GDP growth of 8.9 per cent in 2021-22.

Among other measures announced included a discussion paper on climate risk and sustainable finance, a committee to review the current state of customer service and rationalisation of the net worth requirement for operating units on the interoperable platform for bill payments Bharat Bill Payment System. The RBI also extended the rationalised home loan norms by another year till March 31, 2023.

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android