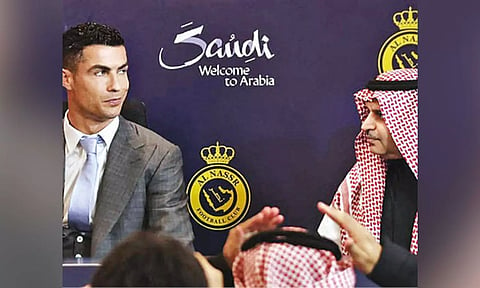

DUBAI: When not tempting the likes of Cristiano Ronaldo, Neymar and Karim Benzema to Riyadh for hundreds of millions of euros a year, Saudi Arabia has regularly opened its deep pockets to prop up ailing businesses in the West.

Together with its neighbors the United Arab Emirates (UAE) and Qatar, the massive Saudi Public Investment Fund (PIF) stepped in at the height of the 2008/9 financial crisis to support several Western banks, even as their own economies cratered along with the oil price.

“The Gulf sovereign wealth funds can invest large sums in an unbureaucratic manner, especially when the going gets tough. They’ve often proved to be white knights for many companies,” Eckart Woertz, Director of the GIGA Institute for Middle East Studies, told DW.

The Kingdom currently has stakes in Nintendo, Uber, Boeing and Newcastle United Football Club. In June, Golf’s PGA Tour agreed on a controversial merger with the Saudi-backed LIV Golf that was denounced by human rights groups.

PIF also owns nearly two-thirds of would-be Tesla rival Lucid Motors, splurging some $5.4 billion (5.04 billion euros) over the past five years on a firm that produces less than 10,000 vehicles per year. The latest investment, albeit much smaller, is Saudi Telecom’s (STC) announcement last week that it had built up a 10% stake in Spain’s telecommunications giant Telefonica, worth some 2.1 billion euros ($2.25 billion).

Over the past eight years, Telefonica’s market value has shrunk by two-thirds. Price wars for mobile and internet services, investments in new technologies and expansion to new markets have left the Spanish firm with a huge debt pile.

The UAE’s phone company e& (formerly Etisalat) this year upped its stake in another major European telecoms firm, Vodafone, from 10% to nearly 15%. Last month, e& said it was considering a further increase to 20%.

The two investments have naturally sparked national security concerns as the Gulf states are autocratic regimes that have a long history of human rights abuses and rampant surveillance of their populations.

Last week, Nadia Calvino, Spain’s first deputy prime minister, said the stake in Telefonica would need to be scrutinized “with the defense of Spain’s strategic interests in mind.”

The Madrid government is said to be particularly wary of Telefonica’s ties with the country’s defense sector.

Britain too is worried whether Vodafone’s tie-up with e& could impact the former’s $19 billion planned merger with rival Three UK, which is currently being scrutinized by the country’s competition watchdog.

Three is owned by Hong Kong-based CK Hutchison and the deal could give China — and also the UAE — access to critical UK communications infrastructure. But some analysts think the concerns may be overblown.

“Saudi Arabia does not pursue comparable interests to China or Russia,” said Woertz. “While China has been pursuing technology that is already installed here in highly sensitive communications infrastructure, that is not the case with Saudi Arabia. They don’t produce high-end technology like China’s Huawei.”

Woertz was referring to the ban placed on Huawei and other Chinese tech firms by the United States and many of its allies in recent years. Western intelligence agencies have raised concerns that Chinese wireless networking equipment could contain backdoors that enable surveillance by Beijing.