Chennai

Even as Indian government is aggressively promoting plastic money and online payments, it’s the consumers who are paying for this initiative by shelling out an extra 1 to 2.5 per cent as PoS (Point of Sales) charges.

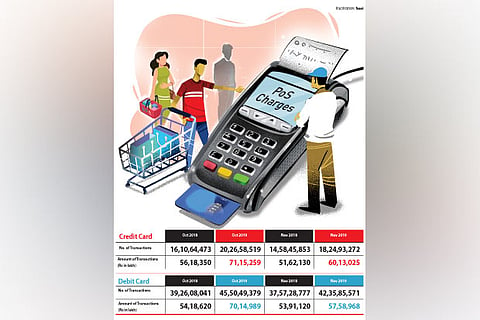

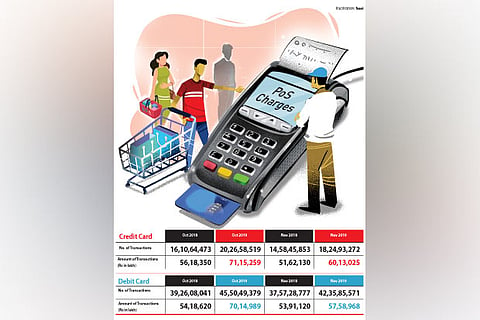

The consumers, who prefer to pay merchants directly via card, are silently being robbed of their hard-earned money every once in a while. To put a ballpoint figure, anywhere between Rs 600 and Rs 1,200 crore is changing hands in the name of transaction charges via debit/credit cards across the country every month.

As per data from the Reserve Bank of India, debit card swipes on Point of Sales (PoS) terminals have jumped more than 27 per cent in March 2019 compared to the corresponding period last year. However, market observers opined that the volume of plastic money transactions is still less and could have been much higher if the fleecing in the name of PoS transactions is not there. Most of the big volume transactions like purchase of gold, etc. are still being conducted mostly by cash to avoid these additional charges.

Customers, who ask the merchant about this extra charge, are often told that it is a service charge on card payment or something else. Whatever be it, most often the customer doesn’t bother to take the merchant to task and either opt to pay it or go in for cash payment. In fact, this additional charge is nothing but Merchant Discount Rate (MDR) – the fee that the shopkeeper has to pay to his service provider for every transaction that happens through PoS. But instead of paying themselves, merchants, who often gain more business when customers opt for card payments, slyly pass it on to the customers.

“I took my bike to an authorised Royal Enfield showroom for servicing. When I tried to pay the bill via debit card, they charged me extra 40 rupees on the bill of Rs 2,000. They told me it was GST. The staff at the counter didn’t even know what GST stands for and I thought it was not worth fighting,” said Gopinath, 27, who faced the issue in Karur district.

S Ashok Kumar, a 25-year-old IT professional, said, “I have been using credit cards at PoS and they always charge two per cent extra. When I questioned a retailer at a prominent shopping mall, they claimed it is a separate tax on card payments.

I told them that the charge should be paid by the merchants and not the customers, but they refused to hear and asked me to better withdraw cash from an ATM and clear the bill. I simply didn’t fight as I didn’t want to leave my family there and search for an ATM or ruin my weekend.”

DT Next spoke to a few nationalised and private bank officials who didn’t have a clear idea on how to go about this. They claimed it was not their fault if merchants pass on the amount to the customers. “Every bank charges the merchants 1-2 per cent as PoS charges based on the transaction value. We’ve different rates for various types of cards and there is no charge if the amount of transaction is below Rs 2,000,” said a Chief Manager of a Union Bank branch in the city.

Jewellery shops, petrol bunks, vehicle showrooms, hospitals and schools are some of the places where the customers often pay an extra per cent if paid via card. “I paid my son’s school fee via card and they charged me Rs 100 on the Rs 5,000 fee amount. And there is also an option where we can pay online via their website. But here we have to pay extra one per cent as convenience fee,” said a parent, who sends his son to a prominent school in Puzhal.

S Rajesh, who owns two petrol bunks in Coimbatore, said, “We don’t charge customers as we know that it is illegal. Many bunks collect a percentage of the bill, that too on large transactions like above Rs 5,000. If they collect extra, you can contact the Area Sales Manager, who would be in charge of the bunks. The number would be displayed at every petrol bunk office.”

A doctor at a dermatologist clinic, who charges for PoS transactions in Anna Nagar, refused to speak to DT Next and asked his staff to respond. The staff said the extra per cent is a convenience fee.

What RBI rules say?

Before even getting into the details of why merchants do this, what one needs to know is that this practice is definitely wrong and that there are RBI regulations that allow penalising such merchants by blacklisting them. “Merchant establishments levy fee as a percentage of the transaction value as charges on customers who are making payments for the purchase of goods and services through debit cards.

Such a fee is not justifiable and permissible as per the bilateral agreement between the acquiring bank and the merchants and therefore calls for termination of the relationship of the bank with such establishments,” according to a Reserve Bank of India notification in this regard.

But banks won’t act

Apparently, the banks, in spite of the RBI regulation, pretend to be hands tied in dealing with the issue. “We can’t do anything if merchants charge extra. We can’t terminate the retailer from offering our PoS services if someone complains to us and frankly we don’t have the statutory power to end the relationship with the business establishment,” said a Senior Manager with Syndicate Bank adding that customers could move consumer forum or court against such merchants.

Advocate Sanjay Pinto, who specializes in consumer cases, said though it is a big scam, people who lose 10 to 50 rupees once in a while don’t prefer to take it up. “We can take the issue before the consumer disputes redressal forum under unfair trade practices. We all know merchants charge extra, but as of now, I have not come across such a case as people mostly don’t want to fight for Rs 10 to 50.”

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android