A financial scam that shook the entire country

Chennai

NOT one of the richest 100 people in Madras in 1900 made it to the wealthiest catalogue. 50 years later, just one investment firm was wholly liable.

Many affluent people in Madras reposed securely on their beds believing that their investments were in safe hands. Although Arbuthnot & Co was not identified as a bank by name, it fulfilled all the functions of one, as far as the public was concerned. Vast sums of money belonging to Rajas, Zamindars, Dewans and more importantly, even Gods (public charitable endowments and private religious trusts on whose interest temples survived) besides the hard-earned investments of the working classes were all within the investment files of Arbuthnots. Even the Governor of Madras, Lawley, had invested his earnings

.

In 1900, Madras ran on four wheels. One was, of course, the Fort St.George. The other three were the ABP of the business world. Parry and Binny were older industries but Arbuthnot, the latest in the trio, was an investment company and grew almost at the speed of the railroads it was financing across the world. Arbuthnot was an off-shoot of Francis Latour & Co established in 1777 whose other partner was the famed De Monte, now buried in Kovalam and supposedly haunts a high-end area in Alwarpet named after him.

Four generations of Arbuthnots worked with the firm but their cousins went on to become Governors of Madras, commanders of the Madras Army and one even became a Governor of the Bank of England. No wonder the public confidence in the integrity of the firm was so unflinching and its transactions bulged.

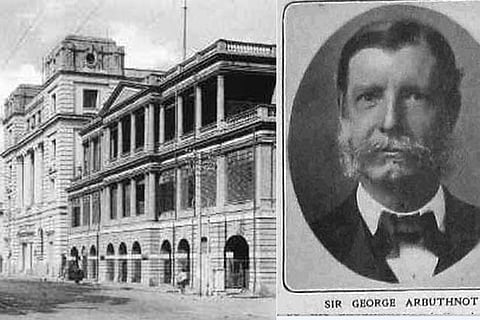

In 1906 the senior partner was Sir George Gough Arbuthnot, a pillar of European Society in Madras. He employed 10,000 people under him. With the Suez Canal dug the world was becoming a village. Arbuthnot, in a move for globalisation, invested in a London branch operated by Macfadyen & Co. Macfadyen invested lavishly in daring enterprises, such as gold, American railway projects and in plantation crops of the West Indies.

Things were going well and profits on books seemed fantastic when one fine day Macfadyen jumped before a running train. “Suicide due to temporary insanity,” was the inquest report. It was definitely insanity, but not temporary. He had brought down the century-old firm with his long-term speculation.

On October 22, 1906, the gates of Arbuthnot & Co, First Line Beach, carried the announcement that the company had suspended payments. Soon the gates were besieged by alarmed investors who were all turned away by police.

The firm petitioned the courts to be declared insolvent. This was not a crunch; this was a national catastrophe. The future of many people was wiped out. The Diwan of Cochin had to sell his unfinished house on Edward Elliot’s Road and start a brick retail shop to feed his family. Even the Governor of Madras, Lawley, lost a lot of his savings. Temples and charities were shut down.

George Arbuthnot was tried for the fraudulent activities and received a sentence of 18 months rigorous imprisonment. A leading newspaper of Madras wrote an editorial -- “For a dozen years now, how many widows, orphans, old pensioners, Government officials and others have been lured into the net of the pretended pompousness of this firm to deposit their money, not knowing that Messrs. Arbuthnot & Co. was but a whited sepulcher?”

The Indian response was remarkable when European integrity and honesty came under a cloud. A young advocate V. Krishnaswamy Iyer, who was representing Arbuthnot creditors, got a brilliant idea. Why not start an Indian alternative? That was more answerable to the public than Arbuthnots had ever been and make it a success.

He got together eight prominent citizens of Madras, many of them from the mercantile community of the cash-rich Chettiars, and together they resolved that an Indian bank had to be incorporated and managed by Indians who were locally known and respected. Co-incidentally, the bank was started on August 15.

In 1909, the Indian bank, which was symbolically the replacement of the Arbuthnots, acquired the outstanding-looking gothic building of Arbuthnots on the Beach Road for Rs 1,35,000 and moved in. The building survived until the 1960s and over it was built a high-rise overlooking the harbour. The road is still called Arbuthnot’s lane.

— The writer is a historian and an author

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android