Chennai

For the first half of the fiscal year of 2018-19, the revised profession tax will be as follows – for those earning up to Rs 21,000, no tax will be levied.

Persons falling in Rs 21,001 to Rs 30,000 bracket will have to pay Rs 135 (from Rs 100), from Rs 30,001 to Rs 45,000, it will be Rs 315 (from Rs 235), Rs 45,001 to Rs 60,000 bracket will pay Rs 690 (from Rs 510), from Rs 60,001 to Rs 75,000, the tax will be Rs 1,025 (from Rs 760) and those earning Rs 75,001 and above will have to pay Rs 1,250 (from Rs 1,095).

A senior Corporation official said that the revision was in the works for a long time.

“There had been talks about a revision for a while now and finally it has been implemented. We are hoping that the revision will increase the revenue by Rs 100 crore,” said the official.

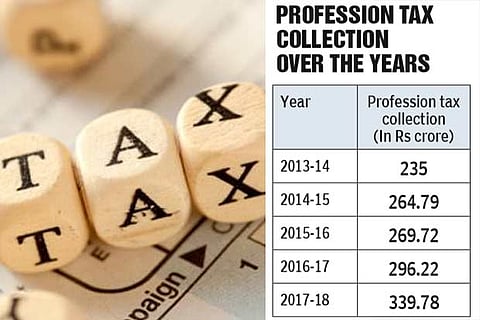

Apart from the property tax, profession tax is the second most important source of revenue for the Corporation. During the financial year of 2017-18, the Corporation had generated a revenue of Rs 339.78 crore through profession tax. Its 2018-2019 budget estimate for revenue through profession tax is Rs

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android