Chennai

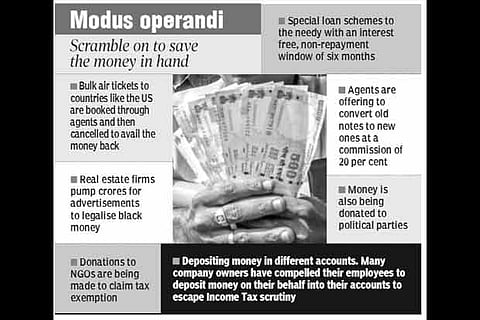

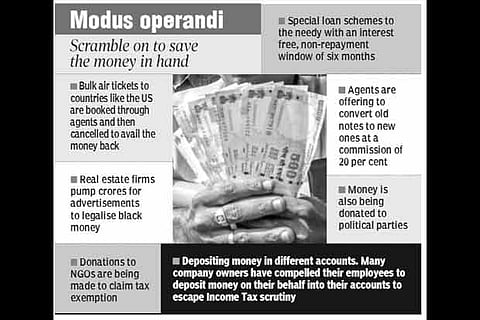

Sources said that the main method adopted by some black money hoarders were to book bulk air tickets to countries like the US through travel agencies. They cancel the tickets later to get the money back. When authorities unearthed this modus operando they instructed the airline agencies to stop accepting old denominations of Rs 500 and Rs 1,000 for such ticket bookings. However, what still baffles the officials were the offers made by certain individuals who volunteer to turn the black money into white at a payment of 20 per cent commission on the currency they collect.

A senior RBI official said “We do not know how they are going to convert the currency so accepted to new valid notes. But the offers are being made across the country and we have some calls recorded regarding this.” With the help of the police, RBI had been identifying the touts who had been camping near the RBI office in Chennai offering various forms of financial help for a commission. “We are driving them away,” said the official. “On the request of RBI, we have been keeping a strict vigil over such fraudsters who approach the people with an offer to provide exchange of notes for a small commission,” confirmed a senior police official. Some agents managed to exchange several crores of old currencies with new notes.

The RBI officials were still figuring out how these agents exchanged the money and from where they got the new notes to pay the original customer. Another method mostly adopted by the real estate dealers was to pump in old currencies in advertisements through the media. Several crores have been pushed into the advertisement industry for placing advertisements across the media for this purpose, officials added. NGOs and charitable organisations too were getting heavy donations.

The donors were ensuring that they could get due exemption under various sections of Income Tax on the donations made. Some of the suspected hoarders were rolling out special loan schemes for farmers. They were offering interest free loans for the first six months too. The loan sharks know well that when the farmers repay their loans they can get back their black money converted to white. They even could charge a marginal interest later. Which was more beneficial than to pay tax and possible penalties if they deposit the amount in banks. Splitting of money and depositing them in different accounts within the non-taxable income bracket is another method used now-a-days. When a larger amount was split, naturally it would miss the scrutiny of Income Tax officials, the official said.

On Sunday, banks shut shop early

While the Reserve Bank of India (RBI) had directed bank across the country to be open for transactions during the weekend, many of the bank branches across Chennai downed their shutters by 4 pm.

The ATM on the premises of a nationalised bank in Vepery saw a long queue, with customers patiently waiting for their turn. In a sharp contrast, the shutters of the bank, which was on the same premises, were downed. Raja, a 44-year-old security guard, said that the bank shut early as the valid cash notes ran out. “While the bank was open till 6 pm on Saturday, it closed by 4 pm on Sunday. Since morning, many customers have been coming to exchange their invalid Rs 500 and Rs 1, 000 rupee notes for legitimate currency. Once the notes got over, the bank closed for the day,” he added. The scene was no different at many branches of private banks in the city. Udaya, the security guard at a private bank branch, said, “The bank shut for the day at 4 pm and the customers too were not many, since it was a Sunday.” However, some of the bank branches were operational till the close of business. Kumari, a home-maker, was irked that she had to spend her precious holiday queuing up at the bank. “The queues are never ending but at least there is some order today unlike before. The police personnel are allowing only one person to enter, which saves time and ensures the process is conducted smoothly,” she said.

Tirunelveli lawyer issues notice to RBI Governor

Tirunelveli-based lawyer and activist, Bramma, had sent a legal notice to RBI Governor on grounds of deficiency of service. In the notice, the lawyer had claimed that he had been maintaining his savings account at Canara Bank for over 10 years and he was also given ATM card with the guarantee that money can be withdrawn anytime. But the RBI had announced that on two days, November 9 and 10, the ATMs would not function and owing to it he was affected very much. Closure of ATMs for two days amounted to deficiency of service, he claimed. Based on the direction of the Court in an airline case, the RBI must provide compensation of Rs 10 lakh for all his suffering.

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android