Chennai

Even as buyers of the demolished twin towers in Moulivakkam ponder their bleak future, legal experts say that while the builder should be held responsible for compensating the buyers who invested in the huge, residential project, the Chennai Metropolitan Development Authority (CMDA) and the state government should also be held responsible for providing sanctions.

Advocate Nalini Chidambaram, who is legally representing the Moulivakkam Trust Heights Affected Flat Buyers Association, said that in this case, the CMDA shouldn’t have sanctioned the project. “We have filed a case against the builder at the National Consumer Court in New Delhi and a writ petition at the Madras High Court, saying that the CMDA has failed to regulate the builder. The soil structure was found to be loose. The sanction should not have been granted for such a huge structure, especially if the foundation was not strong. Though it was the CMDA officials who failed to do their duty, the state government too should be held responsible. The builder and the state government should jointly compensate the buyers,” said the advocate.

Nalini added that the petition is awaiting the Supreme Court verdict on the Meerut fire tragedy at a consumer electronics fair in which 65 people died. It is considered a precedent to the Moulivakkam building collapse. “After appointing a committee to investigate the fire incident, the Supreme Court has passed an interim order, as the state and authorities were found prima facie responsible for violations and negligence, while granting permits for the fair. The state government was directed to pay compensation and organisers were directed to deposit Rs 30 lakh. We are waiting for the high court to set a date for our hearing on the writ petition,” she added.

NL Rajah, senior advocate at the Madras High Court, said reaching out to the government and holding them responsible will dilute the case against the builder. “The builder can always pass the buck, saying the permissions were granted by the government. There are two things that can be done – a contractual case against the developers in the private law. The government sanctioning an unsafe building comes under the purview of public law. The buyers can take to the public law to hold the government responsible and enforce regulations in the real estate sector,” he concluded.

Reliving nightmare, facing economic ruin

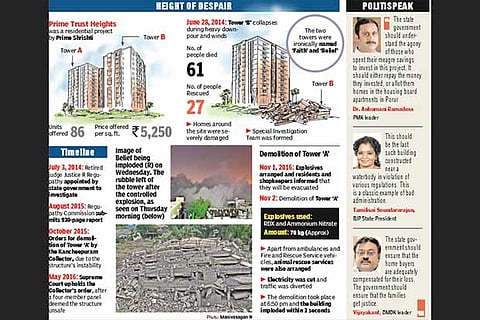

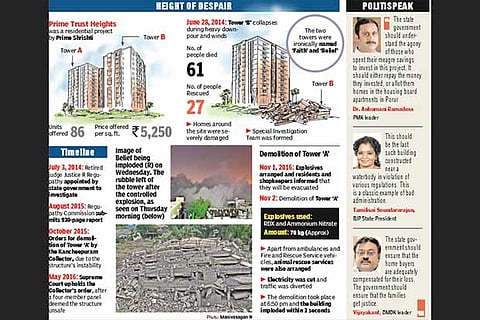

The twin towers of Prime Shristi residential complex at Moulivakkam has not just robbed the homebuyers of their life's savings but has also spelt doom for the residents in the periphery of the now razed buildings.

After the first tower collapsed in 2014, killing 61 people, residents lived in constant fear, especially during last December’s deluge. Now, after the implosion of Belief, the remaining tower, on Wednesday, economic ruin stares them in the face. And, they cannot forget the 2014 crash that started it all. Manivannan, a resident living behind the high-rise, said, “When the remaining tower was standing, we couldn’t sleep properly at night. The first tower had collapsed during heavy rains. After that, whenever it rained, we were worried. Now, thankfully, after the demolition of the building, we can live in peace,” he said.

The infamous towers had spelt financial ruin for three middle-class families. Queen Mary D, mother-inlaw of Daniel SM, a software professional who had bought a home behind the building, recalls the fateful evening of June 28, 2014. “We bought this house in 2012 but lost it in 2014. We had to move to a rented house. Apart from the rent, we were paying our monthly EMI on the housing loan. Six months ago, the bank put a notice on the house, because we couldn’t repay our loan. The future seems bleak,” she said. Abdul Khader, a network engineer, similarly affected, said the insurance companies are not compensating the affected families. “We had paid Rs 10 lakh as insurance but the company stated our claim is non-eligible. Through no fault of ours, we are facing these problems. We cannot afford to buy another house,” added the IT professional.

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android