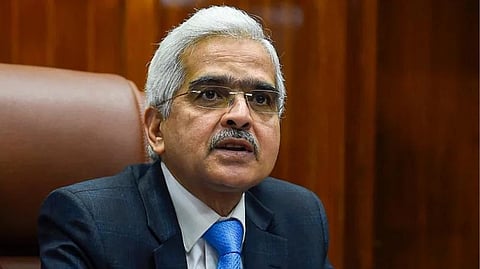

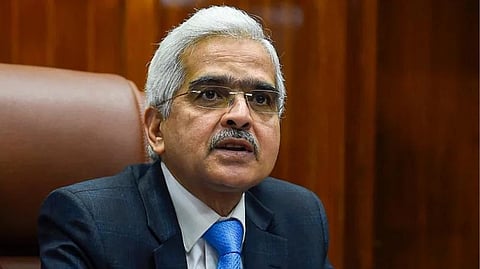

NEW DELHI: RBI Governor Shaktikanta Das on Monday said the impact of withdrawal of Rs 2,000 currency notes will be “very very marginal” on the economy since it accounts for only 10.8 per cent of currency in circulation.

Describing the withdrawal exercise as part of currency management operations of the Reserve Bank, he said, he expects most of the withdrawn Rs 2,000 notes to be returned to the exchequer by the deadline of September 30.

Talking to reporters, Das said, “The impact of this on the economy will be very very marginal because it is only 10.8 per cent of currency in circulation. As you know that Rs 2,000 notes were not commonly used in any transaction, we have found it is hardly being used for carrying out transactions. Therefore, economic activity will not be impacted.”

As part of a clean note policy, he said, RBI has been conducting such exercise of withdrawal of currency notes from time to time and such exercise was undertaken in 2013-14, whereby the notes which were printed prior to 2005, were withdrawn from public circulation. So, he said, withdrawal of Rs 2,000 notes is part of clean note policy. Asked if Rs 2,000 notes will continue to be a legal tender, Das said “It will continue as legal tender. We will wait how many notes are coming. I cannot give a speculative answer about what will happen post September 30.”

Most of the notes are expected to come back, he said, adding “that is our expectation at this stage. We will see how many notes come back. And as we approach September 30, we will decide at that stage.”

He said there is enough time available for exchange and deposit in bank accounts so people should not panic. There is more than adequate quantity of printed notes available in the system not just with the RBI, but also at the currency chests which are operated by the banks With regard to the impact on liquidity management, Das said it will depend on the demand of the people.

“Some of it will get deposited into bank accounts. Some of it will be exchanged. So, what is exchanged across the counter goes back immediately and what is deposited in the bank accounts would depend on the needs of customers,” Das said.

On Rs 1,000 reintroduction, he said, it is a speculative question.

Meanwhile, Zomato tweeted “Since Friday, 72% of our cash on delivery orders were paid in Rs 2,000 notes.”

Pvt consumption, rural demand revival to drive growth

India's growth in the April-June quarter is expected to be driven by private consumption, supported by reviving rural demand, and renewed buoyancy in manufacturing, a Reserve Bank article said on Monday.

The global economy is transfixed in the cross-currents of slowing growth and high inflation, and an uneasy calm prevails in the global financial markets as they await clearer signals from policy authorities on banking regulation and supervision, and contours of deposit insurance, it said.

In April and the first half of May 2023, domestic economic conditions have sustained the quickening of momentum seen in the last quarter of 2022-23, said the article on 'State of the Economy'.

Headline inflation eased below 5 per cent in April 2023, for the first time since November 2021.

It further said corporate earnings are beating consensus expectations, with banking and financial sectors posting strong revenue performance, aided by robust credit growth.

"GDP growth in the first quarter of 2023-24 is expected to be driven by private consumption, supported by revival in rural demand that is underway on the back of the encouraging developments in both the kharif marketing season of 2022-23 and the rabi marketing season of 2023-24, the sustained buoyancy in services, especially contact-intensive sectors, and moderating inflationary pressures," it said..

The article has been authored by a team led by RBI Deputy Governor Michael Debabrata Patra.

The central bank, however, said the views expressed in the article are those of the authors and do not represent the views of the Reserve Bank of India.

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android