CEA confident Indian economy set to perform better

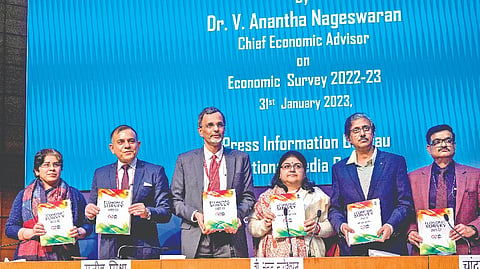

NEW DELHI: Indian economy is poised to do better and is expected to grow 6.5-7 per cent in the remainder of the decade, Chief Economic Advisor (CEA) V Anantha Nageswaran said on Tuesday.

Addressing reporters here after the tabling of the Economic Survey in Parliament by Finance Minister Nirmala Sitharaman, Nageswaran said that by and large, inflation is likely to be “well behaved” in FY2023-24 barring headwinds.

The Economic Survey, which has been prepared by the CEA, stated that RBI’s projection of retail inflation at 6.8 per cent in the current fiscal is neither too high to deter private consumption, nor so low as to weaken inducement to invest.

India’s economy is projected to slow to 6.5 per cent in the fiscal year starting April but will remain the fastest-growing major economy in the world as it fared better in dealing with the extraordinary set of challenges the globe has faced, the Economic Survey 2022-23 said.

Nageswaran said as long as oil prices remain below $100 per barrel, the projected growth rate would remain undisturbed.

Nageswaran pointed out that the quality of public expenditure has gone up and the government has become more transparent with budget deficit numbers. There is increased transparency in public procurement.

The CEA also said credit growth is picking up across sectors, and credit to MSMEs has grown at 30 per cent since January 2022, while NPAs in NBFCs is lower than what it was 15 months ago. He observed India is well ahead of its targets for renewable energy mix.

Adani-Hindenburg face-off

The CEA also refused to comment on the impact of the rout in Adani Group shares following a damning report by Hindenburg, a US-based short seller. “We don’t comment on a single company in the Economic Survey,” he said in an interaction with the media after the Survey was tabled in Parliament.

“Corporate sector as a whole has de-leveraged and balancesheets are healthy. So, what happens to one particular corporate group is a matter between markets and the corporate group,” he said in response to a question on the Adani Group crisis.

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android