Chennai

Last month, Union Finance Minister Nirmala Sitharaman announced a big bank consolidation move that will merge 10 nationalised banks into four large anchor banks-Punjab National Bank, Canara Bank, Union Bank of India and Indian Bank-which will have the flexibility and financial muscle to meet the growing needs of the Indian economy that is going through a slide.

Sitharaman expects that the consolidation will “clear the path” for taking the Indian economy to an ambitious $5 trillion league in the next five-year period. The merger is expected to be completed by the end of the current financial year.

The powerful bank unions, however, disagree. Unions are on the war path, fearing job loss. “The proposals which the government have moved are unmindful since it has no logic or rationale. Neither is it the case that a weak bank is merged with a strong one nor are geographically compatible banks being merged," said the All India Bank Employees Association.

The All India Bank Officers’ Confederation (AIBOC), the All India Bank Officers’ Association (AIBOA), the Indian National Bank Officers’ Congress (INBOC) and the National Organisation of Bank Officers (NOBO) — which had together called for a pan-India strike on September 26 and 27 in protest--have now deferred after the government called for talks.

“The merger plan is another surgical strike on the economy,” said C J Nandakumar, president of the Bank Employees Federation of India (BEFI). “First, they (the government) killed the development banks, a very essential element for a developing economy. In the absence of development banks, commercial banks have been compelled to fund the large projects, especially in mega power and large infrastructure projects. These large creditors never bothered to pay back. This resulted in mounting non-performing assets (bad loans). And for the last few years, banks’ management had been following an unscientific staff reduction strategy,” he said. As a final stroke, Prime Minister Narendra Modi imposed demonetisation that crippled the banking industry further, he added. “The present government is fully responsible for the chaos in the banking sector and slowdown in the economy,” said Nandakumar.

Banking experts believe that merger is a “tricky and painful” process. Branch rationalisation, human resource redeployment and technology integration are challenging tasks for merging entities.

The earlier merger of SBI’s five associated banks with it and of Dena Bank and Vijaya Bank with Bank of Baroda has still not been completed and is facing problems. These mergers were announced, according to trade unions, promising that there would not be any branch closure or retrenchment.

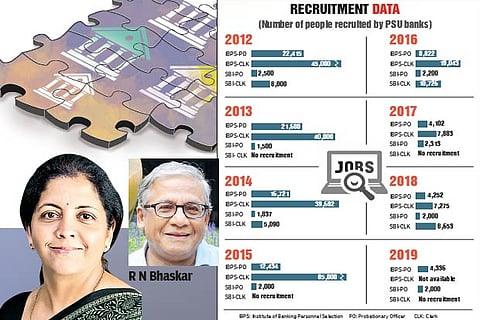

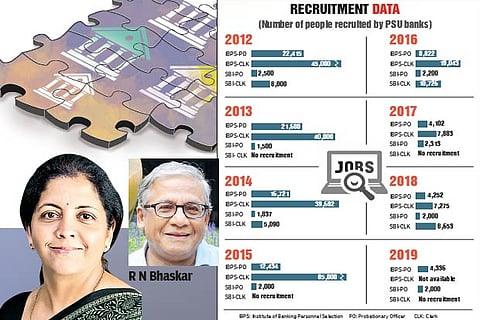

“SBI has already closed down over 2,500 branches and more are likely to be closed down,” said CP Krishnan, secretary, Bank Employees Federation of India - Tamil Nadu. He pointed out that about 40,000 bank employees have retired from PSU banks in 2018-19 alone. Fresh recruitment was less than 12,000. It is unlikely that new recruitment will be done in the next four to five years. The branch closure will lead to human resource redeployment. On many occasions in the past, redeployment has been challenged in the court of law as anchor banks will have an upper hand in seniority and promotions.

In the proposed mergers, Canara Bank and Syndicate Bank will be merged. Both of them are concentrated in Karnataka and the merger will lead to the closure of about 30-40 per cent of bank branches, experts believe. The proposed merger is not addressing such issues.

Banking recruitment has been low in the past four years. Retired staff have not been replaced. “There won’t be any recruitment virtually in the next four years due to the ongoing and newly proposed mergers,” said Nandakumar.

He is of the opinion that PSU banks are understaffed. The latest merger will shrink it further. On the other hand, the government imposes its crazy ideas like demonetisation on the banking staff. Instead of doing banking work, we were compelled to do such work; this, in turn, affects the efficiency of the banks, he said.

Experts also believe that there is still scope to expand banking operations in areas where private banks will not enter. For this, PSU banks will need to preserve their staff strength.

Economist Dr Vinoj Abraham of the Centre for Development Studies said, “The proposed merger is supposed to bring in better efficiency and outcomes into the banking system. If the government can keep national priorities and meet the needs of the growing economy, merger is a good idea. However, the consolidation will reduce competition.”

A key element of the success of the banking industry is proper regulatory mechanism implemented through the central bank. India’s recent history indicates the central bank’s autonomy is diminishing with frequent government interference.

Pointing out the recent interference with the banking regulator RBI, Abraham said, “If the independence of the RBI is taken away, all these exercises will be in vain.”

Nationalisation: Prioritising the need of the nation

The government started the merging cycle in 2017. First, five of the State Bank of India (SBI)’s associate banks along with Bharatiya Mahila Bank merged with SBI. Bank of Baroda absorbed two weaker nationalised banks – Dena Bank and Vijaya Bank. Two banks–Bank of India and Central Bank--are untouched in the exercise. With the recent move to merge 10 banks into four, the number of PSU banks has been reduced to 12 from the earlier 27 (see graphics)

As part of India’s economic growth agenda, the Indian government took Imperial Bank of India under its firm grip, bringing more than one quarter of banking resources under its authority in 1955. The old bank was rechristened as the State Bank of India and become the largest bank of the country and still maintains its leadership position.

In 1960, seven associated state banks came under its fold with Parliament passing the State Bank of India (Subsidiary Banks)

Act, 1959. The nationalisation spree began in 1969 with then Prime Minister Indira Gandhi (she was also the finance minister) nationalising 14 large banks in the country. The main criterion for nationalisation was a Rs 50-crore deposit base for all these banks. In the second spell in 1980, she further nationalised six private banks. (see graphics). The government left a few regional level banks in the private sector and controlled over 80 per cent of the Indian banking industry.

“Bank nationalisation was a big move that aimed to bring inclusion,” said Abraham. Prior to the nationalisation, private banks had been working independently with pure commercial and profit motives. Most of these banks had been under the top industrial groups and mostly served their own interests. Nationalisation brought national priorities to the fore. It helped to spread banks in small towns and rural areas and started serving SMEs and agricultural communities.

In the 1970s and 80s, it was on the right track. Gradually, the political class started influencing banks for corrupt businessmen and diverted funds. RBI data suggests that India’s banking sector has accumulated non-performing assets (NPAs) or bad loans to the tune of of Rs17,55,691 crore for the year ended March 30, 2019. Of this, PSU banks had a share of Rs 8,06,412 crore and the remaining Rs 9,49,279 crore were with the private sector banks. And the economy is not growing as per the expected level - recording a low growth rate of five per cent.

The question is, will consolidation save the PSU banks?

Former RBI governor Y V Reddy said, “No”. While delivering the Prof D T Lakdawala Memorial Lecture on ‘Future of Public Sector Banking” in 2017, he said,“The whole idea that the consolidation of banks will solve the problem of public sector banking is not correct. If the problem is structural, if the problem is governance,it does not matter whether banks are large or small”.

A woman opened account with 25 paise

One of the reasons for the nationalisation of banks was to expand the banking system to remote areas of the country. Ironically, one of the banks nationalised in the very first phase in 1969 was Syndicate Bank, the first bank to have a completely rural customer base, both depositors and borrowers! According to senior journalist and author of Game India, R N Bhaskar, Tonse Madhav Anant Pai, the founder of Syndicate Bank, was the pioneer in rural banking. In his book, Bhaskar describes the Syndicate Bank story as one of the finest management stories.

When TMA Pai completed his medical education and expressed his desire to go to Japan, his mother dissuaded him, asking him instead to serve the people of his village. Malpe was a typical sleepy fishing hamlet where the men went fishing, returned and got drunk. The women cleaned the fish, sold it, procured groceries for the family and put aside excess money. “Pai realised within six months that this was no way to live– that was when he had his Eureka moment; a way to get them rich and a way to become rich as well,” said Bhaskar.

He first taught the women to save 25 paise and also offered to hold it for them, maintaining meticulous records of what each person was giving him. Within a few months, he had collected 1000 rupees. He then encouraged the women to buy cows. To sell the idea, he appealed to their motherly instincts, saying that they should use the first glass of milk for their own children and sell the remaining. After the first woman was convinced, it was easy. When the milk was in excess and he could not buy all of it or store it, he decided to start a co-operative.

He also started the first co-operative bank in South India, which was the North Canara Co-operative Bank. The first branch was set up in 1925 at Udupi. He then went on to start a fishers’ co-operative and a weavers’ co-operative. “The South Indian co-operatives story was not Kurien’s, it was actually Pai’s story,” said Bhaskar. It was TMA Pai who helped secure a trader’s licence for Dhirubhai Ambani, who was a small time trader of yarn. One Pai family member served on the board of Reliance Industries until his death.

Piecing the banking jigsaw puzzle together

Merger of banks is expected to improve the efficiency and profitablity of the banking system. The years 1969 and 1980 marked the days of nationalisation.

Banks nationalised (1969)

1 Allahabad Bank

2 Bank of India

3 Canara Bank

4 Dena Bank

5 Indian Overseas Bank

6 Syndicate Bank

7 Union Bank of India

8 Bank of Baroda

9 Bank of Maharashtra

10 Central Bank of India

11 Indian Bank

12 Punjab National Bank

13 Uco Bank

14 United Bank of India

Banks nationalised (1980)

1 Andhra Bank

2 Punjab & Sind Bank

3 New Bank of India

4 Vijaya Bank

5 Corporation Bank

6 Oriental Bank of Commerce

PSU banks after merger

1 State Bank of India

2 Bank of Baroda

3 Punjab National Bank

4 Canara Bank

5 Union Bank

6 Indian Bank

7 Indian Overseas Bank

8 Uco Bank

9 Bank of Maharashtra

10 Punjab and Sind Bank

11 Bank of India

12 Central Bank of India

- News Research Department

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android