Chennai

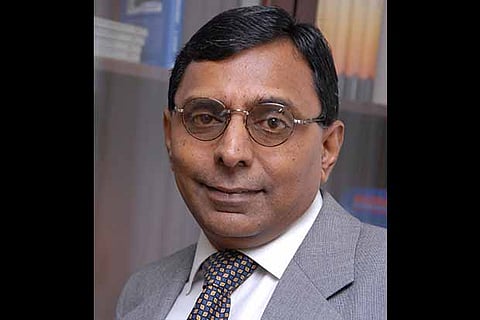

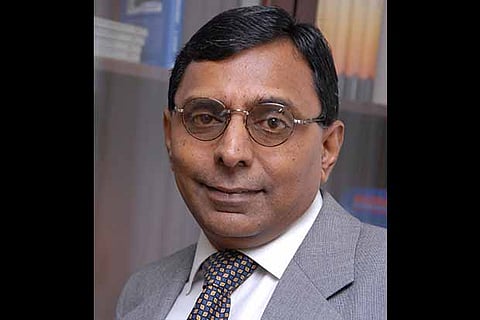

The substantial surge in market cap from $5.6 billion, a year ago reflects the “relative competitiveness” of the business aided by “positive policy environment” that had driven the performance of many of its businesses, Murugappa Group Executive Chairman A Vellayan said here on Friday.

The triggers for this boost, he reasoned, were “better performance,” investor confidence in India and a strong rupee that had helped some of the businesses. TI, Chola Finance and Coromandel, in particular, had done well as the group’s EBITDA margins went up by 3 per cent to touch 14 per cent.

Giving a sector-by-sector overview of the group’s performance, he said the sugar industry which had been in “doldrums” two years ago had ended on a positive note across the country. A number of measures taken by the Centre, which included removing excise duty on molasses and timely import of raw sugar, had helped the sugar business of the group to post a profit after tax of Rs 302 crore against Rs 135 crore loss in the previous year.

Vellayan lauded the government’s timely market intervention and responsive steps to arrest the sugar price shooting up to Rs 42 a kg. He said despite the drought in TN, Maharashtra and Karnataka impacting growth, things will look up soon.

On fertiliser business, he said domestic capacities were operating at 70 per cent. “The full stock of capacities is taken by the ministry concerned, which vets the supply plan so that imports and logistics challenges can be addressed,” he said, adding the GST implementation would eke out unorganised players, who were hurting the trade by the supply of substandard materials. These steps will help the government save Rs 20,000 crore in subsidy payouts.

He said the group is gearing up the next phase of investment in October-November, when its plants are expected to attain 85 to 90 per cent capacities. During the year 2016-17, a capex of Rs 398 crore had been used for expansion, debottlenecking and modernising facilities across the group. On the agri-retail front, Vellayan said, the Rs 1,300 crore vertical is now operating through 800 outlets. This will go up to 1,000 when the company expands to Maharashtra, Orissa, Chattisgarh this year. The retail operations had turned profitable in the last three years.

The group’s exports were Rs 3,400 crore compared to Rs 2,700 crore the previous year. Agro-chemical, cycle and tube businesses will drive the growth, Vellayan said, adding they had expanded their operations to Karnataka, AP, Gujarat and West Bengal, with TN business reporting growth dip over the last five years.

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android