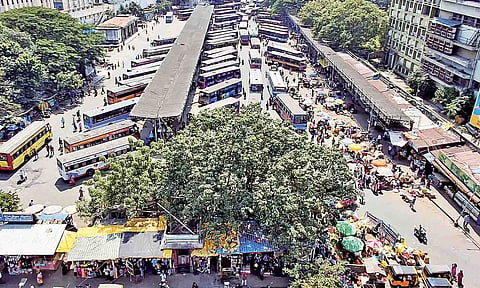

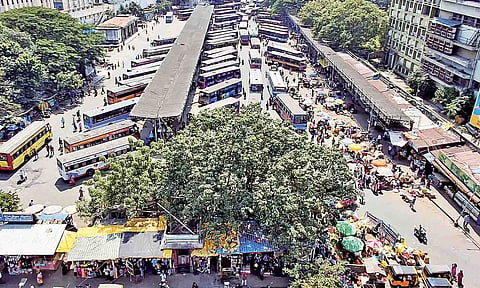

CHENNAI: After witnessing a good response from the market for its municipal bonds listed on Monday, the Greater Chennai Corporation has decided to use the same route to raise Rs 500 crore for the Broadway bus terminus redevelopment project.

Including the Broadway project, the civic body is planning to expand the issuance of municipal bonds for other infrastructure development projects, added Corporation Commissioner J Kumaragurubaran.

Earlier in the day, Chief Minister MK Stalin launched the listing of the Greater Chennai Corporation municipal bonds in the National Stock Exchange (NSE) at an event in Chennai on Monday. Speaking to the media along with the chief economist of NSE Tirthankar Patnaik, Kumaragurubaran said the issuance of bonds has received an overwhelming response from investors.

“The investors gave a great response to our initiative, as we received bids of Rs 421 crore to the base issue of Rs 100 crore, which is four times higher,” said Kumaragurubaran.

Of the Rs 570 crore that is its share for the Broadway redevelopment plan, the GCC is planning to generate Rs 500 crore through municipal bonds in the future, he said.

The bond issue and the response it received were a great moment in the NSE’s view, added its chief economist, Patnaik. “We hope that the scheme will be expanded to other cities in Tamil Nadu,” he added.

Confirming this, Commissioner Kumaragurubaran said other major municipal corporations, including Tiruchy, Tirupur, and Coimbatore, were following Chennai’s lead and were all set to issue similar bonds – each worth Rs 100 crore – to generate funds to undertake developmental projects.

Besides acting as a ready source of funds, raising money from the market in this manner had other benefits as well for the Chennai Corporation, said the Commissioner. The civic body was raising funds at 7.97 per cent, which is cheaper than any bank loans. Also, GCC has been given an impressive AA+ rating, which it is aiming to maintain by ensuring financial discipline.