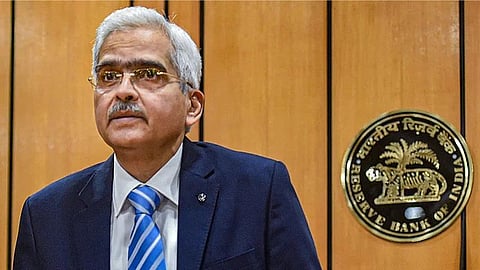

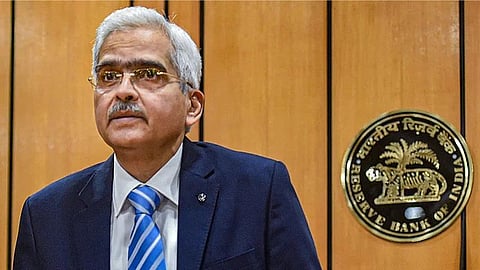

MUMBAI: Reserve Bank governor Shaktikanta Das on Friday reiterated his call for an outright ban on cryptocurrencies, saying these are “nothing but gambling” and their perceived “value is nothing but make-believe.”

Speaking at an event this evening here, Das reiterated the need for an outright ban on cryptos saying though those supporting it call it an asset or a financial product, there is no underlying value in it not even a tulip (alluding to the Dutch tulip mania blow-up in the early part of the past century).

“Every asset, every financial product has to have some underlying (value) but in the case of crypto there is no underlying… not even a tulip…and the increase in the market price of cryptos, is based on make-believe. So anything without any underlying, whose value is dependent entirely on make-believe, is nothing but 100 per cent speculation or to put it very bluntly, it is gambling,” the governor said.

“Since we don’t allow gambling in our country, and if you want to allow gambling, treat it as gambling and lay down the rules for gambling. But crypto is not a financial product,” Das asserted.

Warning that legalising cryptos will lead to more dollarisation of the economy, he said cryptos masquerading as a financial product or financial asset, is a completely misplaced argument. Explaining it, he said the bigger macro reason for banning them is that cryptos have the potential to and the characteristics of becoming a means of exchange; an exchange of doing a transaction.

“Since most cryptos are dollar-denominated, and if you allow it to grow, assume a situation where say 20 per cent of transactions in an economy are taking place through cryptos issued by private companies. Central banks will lose control over that 20 per cent of the money supply in the economy and their ability to decide on monetary policy and to decide on liquidity levels. Central banks’ authority to that extent will get undermined, it will lead to a dollarisation of the economy.

“Please believe me, these are not empty alarm signals. One year ago in the Reserve Bank, we had said this whole thing is likely to collapse sooner than later. And if you see the developments over the last year, climaxing in the FTX episode, I think I don’t need to add anything more,” Das said.

Visit news.dtnext.in to explore our interactive epaper!

Download the DT Next app for more exciting features!

Click here for iOS

Click here for Android